In the intricate dance of fiscal policies and economic relief, a financial windfall is quietly approaching for a select group of taxpayers. As the IRS prepares to distribute checks that could reach up to $1,400, a million Americans stand on the cusp of an unexpected monetary boost. But who are these lucky recipients, and what cosmic alignment of bureaucratic mechanisms has triggered this timely injection of funds? This article peels back the layers of a complex financial narrative, revealing the human stories behind the numbers and exploring the context of this imminent cash infusion. The latest wave of relief payments is set to hit bank accounts across the nation, bringing financial reprieve to a significant number of taxpayers. These payments stem from a complex settlement related to pandemic-era tax complications and ongoing economic recovery efforts.

Eligible recipients primarily include individuals who filed tax returns during specific years and experienced unique financial challenges during the COVID-19 pandemic. The Internal Revenue Service has meticulously compiled a list of qualifying taxpayers based on intricate criteria developed through extensive data analysis.

Individuals who filed their 2020 and 2021 tax returns and experienced economic hardships are most likely to receive the funds. The payments target specific demographic groups, including self-employed professionals, gig workers, and independent contractors who faced significant income disruptions during the pandemic.

Mathematical algorithms developed by the IRS have identified approximately one million taxpayers who meet the precise requirements for these supplemental payments. Each recipient can expect up to $1,400, representing a targeted approach to providing economic relief where it is most needed.

The timing of these payments is strategic, coinciding with ongoing economic recovery efforts and addressing lingering financial challenges from the pandemic’s economic upheaval. Government officials suggest these funds will help stabilize individual financial situations and inject modest economic stimulus into local communities.

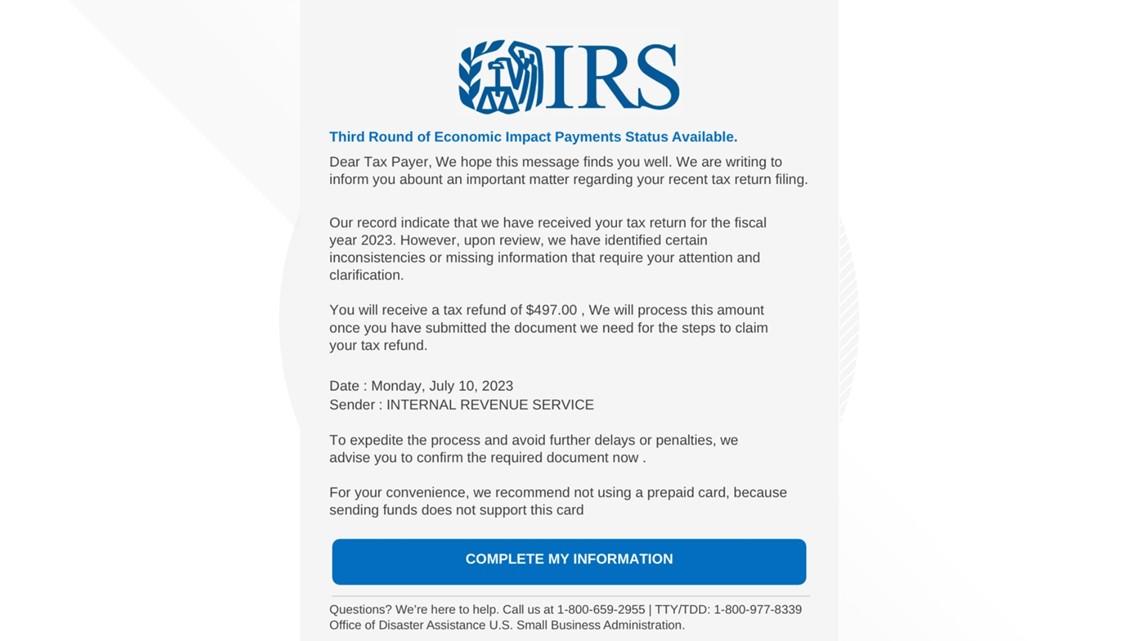

Verification processes are rigorous, with multiple cross-references to ensure accuracy and prevent potential fraud. Taxpayers selected for these payments will receive direct notifications through official IRS communication channels, including email and postal mail.

Demographic data reveals that recipients represent a diverse cross-section of American workers, including urban professionals, rural workers, and individuals from various economic backgrounds. The payment structure considers individual tax situations, previous economic impact payments, and specific pandemic-related financial challenges.

Financial experts recommend recipients carefully review their eligibility details and ensure all required documentation is current. The IRS advises potential recipients to maintain updated contact information and be prepared for potential additional verification steps.

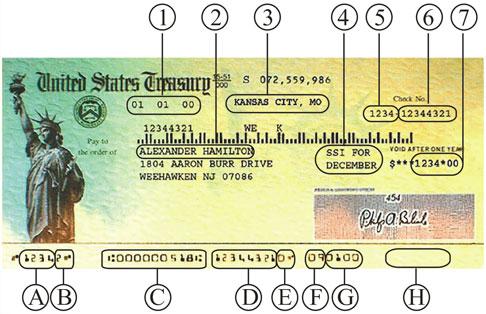

Banking information from previous tax returns will be used for direct deposit, with alternative payment methods available for those without traditional banking accounts. The process is designed to be seamless and efficient, minimizing bureaucratic complications.

These payments represent more than just financial assistance; they symbolize ongoing government efforts to support citizens through unprecedented economic challenges. As the economic landscape continues to evolve, such targeted relief measures remain crucial in maintaining financial stability and supporting individual economic resilience.