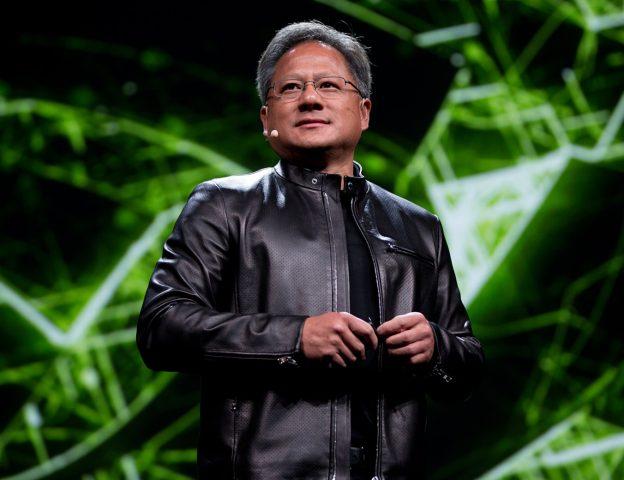

In the high-stakes world of tech titans and corporate chess, Nvidia’s visionary CEO Jensen Huang finds himself at the center of a potentially explosive tax controversy. A recent New York Times investigation suggests that the semiconductor superstar, who has rocketed to become the 10th-wealthiest individual in the United States, may be navigating complex financial strategies to sidestep an astronomical $8 billion tax bill. This revelatory report peels back the layers of sophisticated financial maneuvering, offering a glimpse into the intricate dance of wealth, power, and fiscal responsibility that defines today’s corporate landscape. As Huang’s technological empire continues to reshape the global computing ecosystem, the spotlight now turns to the financial machinations behind his remarkable success. In the intricate world of corporate finance and tax strategies, a recent New York Times investigation has cast a spotlight on Jensen Huang, the visionary CEO behind Nvidia’s technological empire. The report alleges a sophisticated tax avoidance scheme potentially shielding billions in potential tax liabilities.

Huang, whose meteoric rise in the tech industry has positioned him as the 10th-wealthiest individual in the United States, reportedly employs complex financial mechanisms to minimize his tax burden. The alleged strategy involves intricate offshore structures and strategic asset allocation designed to circumvent traditional tax reporting requirements.

The investigation reveals a labyrinthine network of financial transactions that potentially redirect substantial portions of Huang’s substantial wealth away from standard tax collection processes. These mechanisms, while potentially legal, raise significant questions about the broader systemic inequities in current tax regulations.

Nvidia’s extraordinary market performance, particularly in artificial intelligence and graphics processing technologies, has been a primary driver of Huang’s unprecedented wealth accumulation. The company’s stock surge has transformed Huang from a successful tech entrepreneur to a billionaire with unprecedented financial flexibility.

Legal experts consulted in the report suggest that while the strategies might technically comply with existing tax codes, they represent a morally questionable approach to wealth management. The potential $8 billion in tax avoidance represents a sum larger than the annual budgets of many mid-sized nations.

The allegations highlight ongoing debates about corporate taxation, wealth concentration, and the increasingly sophisticated methods wealthy individuals employ to protect their financial interests. Huang’s case exemplifies the complex intersection of technological innovation, corporate leadership, and financial strategy.

Regulatory bodies and tax authorities are likely to scrutinize the detailed findings, potentially triggering investigations or legislative discussions about closing perceived loopholes in current tax frameworks. The report underscores the growing tension between individual wealth accumulation and societal expectations of fair contribution.

Nvidia has not officially responded to the specific allegations, maintaining its standard practice of reserved communication regarding executive financial matters. Huang himself remains a respected figure in the technology sector, known for his innovative leadership and transformative approach to computing technologies.

The unfolding narrative promises to generate significant discussion about wealth, taxation, and the evolving landscape of corporate financial strategies in the 21st-century global economy.