Imagine unlocking a hidden financial secret that could transform your retirement strategy—a nuanced twist in the Social Security rulebook that most retirees overlook. While conventional wisdom suggests claiming benefits signals the end of meaningful work, there’s a surprising potential for benefit enhancement that defies traditional expectations. This article peels back the layers of a complex system, revealing how strategic employment after claiming Social Security might actually be a calculated move to maximize your lifetime earnings. What if continuing to work isn’t just about supplemental income, but a sophisticated method to incrementally boost the very benefits you’ve already started receiving? Many retirees are unaware of a strategic mechanism within Social Security that can actually boost their lifetime benefits. The key lies in understanding the nuanced relationship between continued work and benefit calculations, even after initially claiming retirement payments.

When individuals continue working while simultaneously receiving Social Security benefits, their annual earnings are carefully reviewed by the Social Security Administration. This ongoing assessment can potentially trigger benefit recalculations that many don’t realise exist.

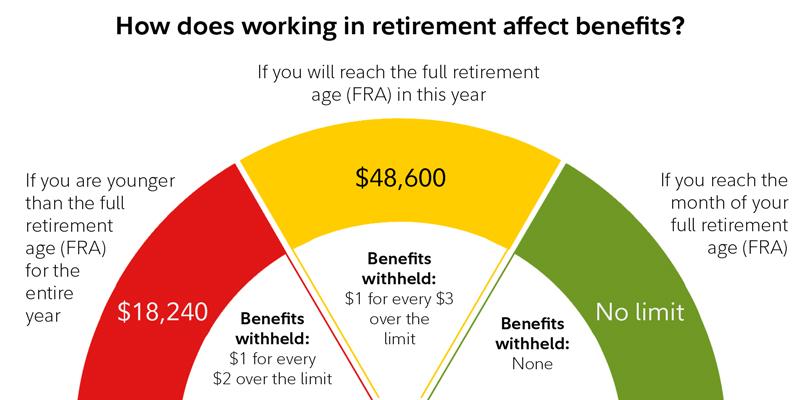

For workers between full retirement age and 70, earned income above certain thresholds can prompt retroactive adjustments to their monthly benefit amount. If current year earnings exceed previous historical earnings, the administration will automatically recalculate the benefit computation, potentially increasing the monthly payment.

The complex formula considers your 35 highest-earning years, adjusted for inflation. Each additional year of work potentially replaces a lower-earning year in this calculation, incrementally elevating your lifetime benefit structure. This means continued employment isn’t just about immediate income, but can strategically enhance long-term Social Security returns.

Notably, this mechanism differs from the common misconception about benefit reduction for early claimers. Instead, it represents a nuanced optimization strategy that rewards continued professional engagement and sustained earning potential.

Individuals approaching retirement should carefully document their earnings and understand how each additional year of work might impact their Social Security calculation. Some professionals might find that strategic part-time employment or consulting work can meaningfully improve their lifetime benefit trajectory.

The recalculation process isn’t automatic for everyone. Proactive communication with the Social Security Administration and maintaining meticulous income records becomes crucial. Workers should request periodic benefit reviews and understand how current earnings might positively influence their long-term retirement income.

Furthermore, this strategy becomes particularly compelling for professionals in high-earning fields or those experiencing career peak earnings in later years. The potential for incrementally higher lifetime benefits can represent a significant financial advantage that extends well beyond immediate retirement planning.

Technology and changing workforce dynamics have made continued professional engagement more accessible than ever. What was once considered “retirement” now frequently represents a transitional phase of flexible, strategic earning and continued professional contribution.

By understanding these nuanced benefit calculation methods, retirees can transform their approach to post-retirement work from a supplemental income strategy to a sophisticated financial optimization technique that potentially yields substantial long-term economic benefits.