As the financial landscape continues to evolve, savvy consumers are always on the lookout for opportunities to maximize their banking rewards. January 2025 brings a fresh wave of enticing bank account promotions that could potentially pad your wallet with up to $3,000 in bonus cash. From traditional brick-and-mortar institutions to innovative digital banks, this comprehensive guide unveils 18 standout offers that promise to turn your financial resolutions into tangible gains. Whether you’re looking to open a new checking account, boost your savings, or simply capitalize on strategic sign-up bonuses, this curated list provides a roadmap to turning the new year into a financially opportune season. As the new year kicks off, banks are rolling out enticing promotions to attract new customers and reward existing ones. These lucrative offers provide an excellent opportunity for savvy consumers to boost their financial standings with minimal effort.

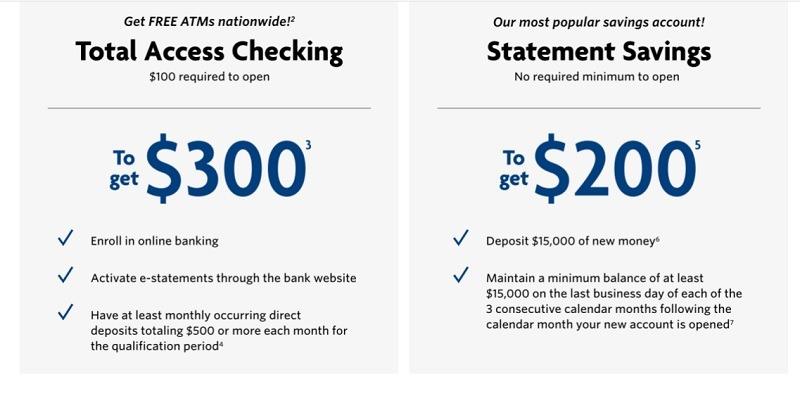

Wells Fargo continues to lead the pack with a compelling $300 bonus for qualifying checking account openings. Their streamlined application process and straightforward requirements make this an attractive option for those looking to switch banks or establish a new financial relationship.

Chase Bank introduces a tiered bonus structure ranging from $200 to $500 depending on initial deposit amounts. New customers can maximize their earnings by meeting specific direct deposit and account activity benchmarks within the first 90 days.

Bank of America offers a unique $350 promotion targeting digital-first customers. Their mobile banking platform and comprehensive sign-up bonuses make this an appealing choice for tech-savvy individuals seeking convenience and financial rewards.

Citibank’s promotion stands out with a generous $500 bonus for high-balance accounts. Customers need to maintain a minimum deposit and complete specified transaction requirements to unlock the full incentive.

Online banks like Ally and Capital One are disrupting traditional banking with competitive digital-only offers. Their promotions include cash bonuses, reduced fees, and higher interest rates that challenge conventional banking models.

Regional banks such as PNC and TD Bank are also entering the competitive landscape. Their localized promotions cater to specific market demographics, offering tailored incentives that reflect community banking principles.

Credit unions are not far behind, with some institutions providing up to $600 in welcome bonuses. These member-owned financial cooperatives often feature more personalized service and community-focused rewards.

Emerging digital banks like Chime and SoFi are introducing innovative sign-up bonuses that integrate seamlessly with modern financial technology. Their promotions often include cryptocurrency rewards and investment account perks.

Strategic consumers can potentially earn multiple bonuses by carefully navigating different bank offers. However, it’s crucial to read the fine print and understand each promotion’s specific requirements and potential tax implications.

Factors like minimum deposit amounts, direct deposit obligations, and account maintenance periods vary across different promotions. Careful research and planning can help maximize potential earnings and benefits.

These promotions represent more than just monetary incentives; they reflect a competitive banking landscape increasingly focused on attracting and retaining customer loyalty through innovative financial products and services.