In the rapidly evolving landscape of automotive manufacturing, a seismic shift is underway. The industry’s traditional giants are now engaged in a high-stakes survival game, where scale and technological innovation are the ultimate determinants of success. As smaller players struggle to keep pace, a new paradigm is emerging—one where only the most robust and adaptable automakers will navigate the complex terrain of electrification, autonomous technology, and global market dynamics. This is not just a transformation; it’s a brutal culling that will reshape the automotive world as we know it. The automotive landscape is undergoing a seismic transformation that will reshape the industry for decades to come. Traditional manufacturing models are crumbling as giants like Tesla, Volkswagen, and emerging Chinese powerhouses consolidate their market positions through strategic mergers and aggressive technological investments.

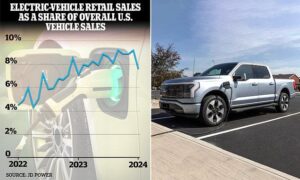

Electric vehicles have become the primary battleground where survival is determined by scale, innovation, and capital resources. Smaller manufacturers are finding themselves increasingly marginalized, unable to compete with multi-billion dollar research and development budgets of global conglomerates. The era of boutique car brands is rapidly diminishing.

Technological complexity now demands unprecedented financial commitments. Advanced autonomous driving systems, sophisticated battery technologies, and interconnected digital platforms require enormous investments that only the largest players can sustainably manage. Companies without substantial financial reserves are being systematically pushed to the periphery or forced into strategic partnerships.

Chinese manufacturers like BYD and NIO are aggressively expanding globally, challenging traditional Western automotive paradigms. Their government-backed development strategies and massive production capabilities are creating new competitive dynamics that established European and American brands must urgently address.

Silicon Valley’s influence continues to disrupt traditional automotive hierarchies. Tech companies with massive computational capabilities are transforming vehicle design, introducing radical concepts that blend software engineering with transportation infrastructure. The lines between technology corporations and automotive manufacturers are increasingly blurred.

Consolidation is becoming the primary survival strategy. Smaller brands are being absorbed or strategically partnered, creating mega-entities capable of competing on a global scale. Volkswagen’s aggressive acquisition strategy and General Motors’ electric vehicle investments exemplify this trend of industrial concentration.

Battery technology remains the critical differentiator. Manufacturers investing heavily in next-generation energy storage solutions will determine the future competitive landscape. Companies demonstrating breakthrough innovations in range, charging speed, and sustainable production will emerge as industry leaders.

Environmental regulations are accelerating this transformation. Stringent emissions standards across Europe, China, and North America are forcing radical redesigns and technological innovations. Traditional internal combustion engine manufacturers face existential challenges, compelling them to rapidly adapt or risk obsolescence.

The next decade will witness unprecedented industrial metamorphosis. Only organizations with visionary leadership, substantial financial resources, and technological adaptability will survive. The automotive world is no longer about building cars—it’s about creating comprehensive mobility ecosystems that integrate transportation, technology, and sustainability.