In the dizzying landscape of American wealth-building, where dreams of financial freedom flicker like neon signs in a bustling metropolis, one voice cuts through the noise with razor-sharp clarity. Maria Bartiromo, the acclaimed financial journalist and television personality, has distilled decades of economic insight into a singular, potent directive that could be the key to unlocking millionaire status. As 2025 beckons with its promise of economic shifts and opportunities, her advice stands as a beacon for those navigating the complex terrain of personal finance. But will this golden rule resonate with aspiring wealth-builders, or will it be cast aside like another fleeting piece of advice in the cacophony of financial guidance? In the high-stakes world of wealth building, financial powerhouse Maria Bartiromo has consistently emphasized one pivotal strategy that separates successful investors from the struggling masses. Her core principle isn’t about getting lucky or inheriting a fortune—it’s about disciplined, strategic financial planning that transforms ordinary income into extraordinary wealth.

The golden rule centers on consistent investment, particularly in retirement accounts and diversified market vehicles. Most Americans mistakenly believe millionaire status requires exceptional intelligence or rare opportunities. However, Bartiromo argues that systematic savings and intelligent investment choices are the true pathways to financial independence.

Compound interest becomes the silent wealth multiplier. By consistently investing even modest amounts—$300 to $500 monthly—individuals can leverage time and market growth to build substantial portfolios. The mathematics are compelling: regular contributions combined with strategic asset allocation can transform middle-class incomes into millionaire portfolios within 15-20 years.

Retirement accounts like 401(k)s and Roth IRAs aren’t just savings vehicles—they’re wealth-generation engines. Maximizing employer matching programs represents free money that accelerates wealth accumulation. Those who contribute the maximum allowable amounts consistently outperform peers who treat investments casually.

Technology has democratized investment strategies once reserved for Wall Street elites. Online platforms, robo-advisors, and fractional share investing enable individuals to build diversified portfolios with minimal initial capital. The barriers to entry have never been lower.

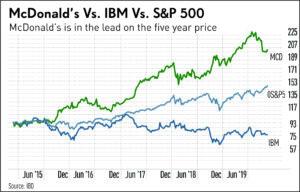

Risk management remains crucial. Bartiromo advocates for balanced portfolios that blend aggressive growth stocks with stable index funds and bonds. This approach mitigates potential market volatility while maintaining long-term appreciation potential.

Her recommended strategy isn’t about getting rich quickly but building sustainable wealth methodically. Young professionals in their 20s and 30s possess the most significant advantage: time. Each year of consistent investment compounds potential returns exponentially.

Psychological discipline distinguishes successful investors. Emotional decision-making—panic selling during market downturns or chasing trendy stocks—undermines long-term wealth creation. Successful investors maintain strategic focus, understanding that temporary market fluctuations are part of the broader investment journey.

Tax-efficient investing strategies further amplify wealth generation. Understanding retirement account contributions, capital gains implications, and strategic tax planning can preserve more hard-earned money.

The millionaire’s path isn’t mysterious—it’s methodical. Consistent investment, strategic planning, and unwavering commitment transform ordinary financial trajectories into extraordinary wealth narratives.