As the golden years approach, many retirees find themselves navigating a complex landscape of financial and legal considerations. While retirement promises relaxation and peace, ensuring your legacy and protecting your loved ones requires strategic planning. In this essential guide, we’ll unpack three critical documents that serve as the cornerstone of comprehensive estate planning—a roadmap to securing your future and providing clarity for those you cherish most. As retirement approaches, safeguarding your financial legacy becomes paramount. Three critical documents can transform your end-of-life planning from a potential legal minefield into a smooth, structured transition for your loved ones.

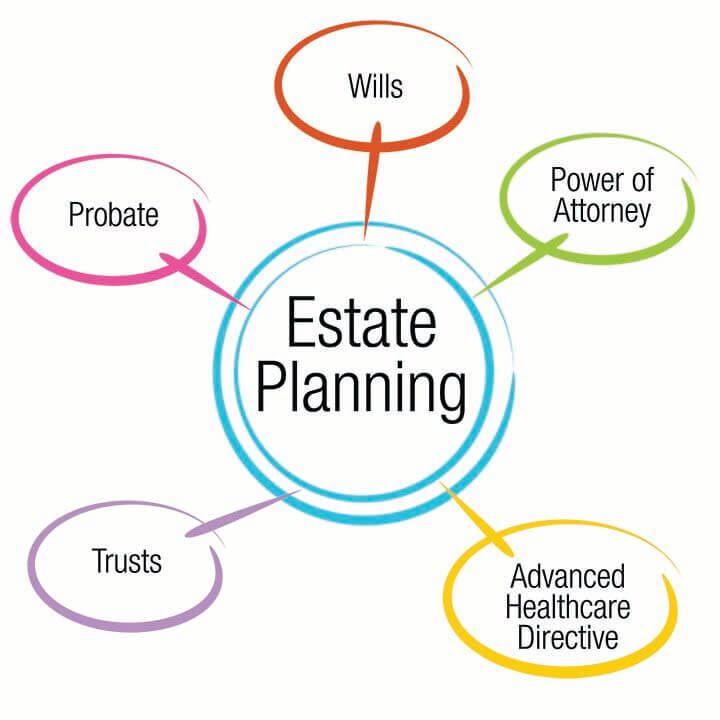

A comprehensive will stands as your primary legal blueprint. This document dictates how your assets will be distributed, preventing potential family disputes and ensuring your final wishes are respected. Without a will, state laws determine asset allocation, which might contradict your personal preferences. Consider detailing specific bequests, naming executors, and addressing potential guardianship for dependents.

Power of attorney represents another crucial protection mechanism. This legal instrument empowers a trusted individual to manage your financial and medical decisions if you become incapacitated. Two distinct types exist: financial and healthcare. The financial power of attorney manages monetary transactions, investment decisions, and property management. Healthcare power of attorney allows your designated representative to make critical medical choices when you cannot communicate independently.

An advanced healthcare directive completes this essential trio of retirement planning documents. Often called a living will, this directive specifies your medical treatment preferences during end-of-life scenarios. It provides clear guidance about life-sustaining treatments, pain management, and personal medical choices when you cannot articulate them yourself.

Selecting the right representatives requires careful consideration. Choose individuals demonstrating financial responsibility, emotional stability, and alignment with your personal values. Communication becomes key – discuss your expectations transparently with potential appointees before finalizing legal documentation.

Digital assets represent an emerging consideration in modern estate planning. Many retirees now possess substantial digital footprints, including online financial accounts, cryptocurrency investments, and social media profiles. Consider creating a comprehensive digital asset inventory, including access credentials and explicit instructions for management.

Professional legal consultation can streamline this complex process. Estate planning attorneys offer nuanced guidance tailored to individual circumstances, helping navigate potential tax implications and ensuring document validity. While online templates exist, personalized professional support mitigates potential legal complications.

Regular document review ensures continued relevance. Life transitions like marriage, divorce, births, and significant financial changes necessitate periodic updates. Aim to reassess these critical documents every three to five years or following major life events.

Proactive estate planning transcends mere legal documentation. It represents a compassionate gift to your loved ones, reducing potential stress and uncertainty during emotionally challenging periods. By implementing these three fundamental documents, retirees can create a comprehensive framework protecting their legacy and providing peace of mind.