Here’s a creative, neutral introduction:

The golden years of retirement often glimmer with promises of leisure and financial security, but for some, the reality can be starkly different from the dream. After years of careful planning and strategic waiting, claiming Social Security at the traditional late-retirement age of 70 might seem like a prudent choice. Yet, for an increasing number of retirees, this decision comes with unexpected complications and a sense of lingering regret that challenges conventional wisdom about retirement timing. When I decided to delay claiming my Social Security benefits until age 70, I believed I was making a financially prudent choice. The promise of maximized monthly checks and the advice from countless financial advisors seemed like a foolproof strategy. However, the reality has been far more complex and disappointing than I initially anticipated.

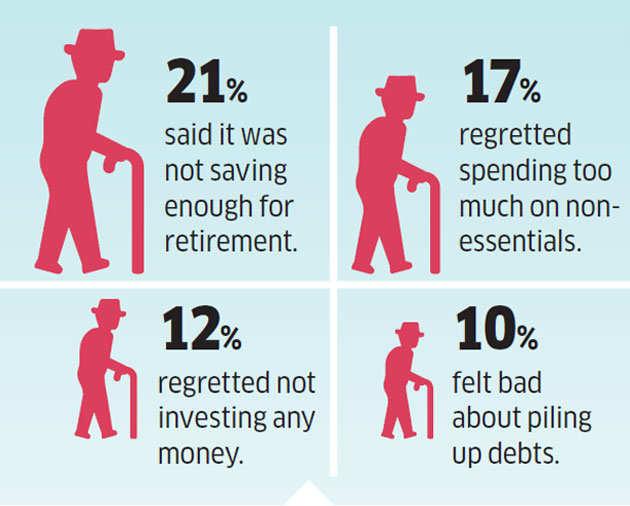

The primary motivation behind waiting was the potential for increased monthly benefits. By deferring my claim, I would receive a higher percentage compared to claiming earlier. What I didn’t fully comprehend was the opportunity cost of those waiting years and the potential health implications that would significantly impact my retirement experience.

My health took an unexpected turn shortly after turning 70. Medical expenses began mounting, and the increased Social Security payments didn’t proportionally offset the rising healthcare costs. The additional dollars I gained from delaying my claim were quickly consumed by medical treatments and unexpected healthcare challenges.

Moreover, I underestimated the quality of life I was sacrificing during those additional working years. The extra income seemed attractive on paper, but the physical and emotional toll of continuing to work was substantial. The stress of maintaining professional performance while managing age-related challenges became increasingly difficult.

Another critical factor I overlooked was the changing economic landscape. Inflation and market volatility have eroded the perceived financial advantage of waiting. The incremental increase in monthly benefits doesn’t necessarily translate to meaningful financial security, especially when considering the years of potential enjoyment lost.

The psychological impact has been equally significant. Watching peers enjoy retirement, travel, and pursue personal passions while I continued working created a sense of missed opportunities. The financial calculus I had meticulously planned didn’t account for the intangible aspects of life’s quality and personal fulfillment.

Retrospectively, claiming benefits earlier might have provided more flexibility and freedom. The additional years of potential enjoyment, reduced work-related stress, and earlier access to retirement funds could have offered a more balanced approach to my post-career life.

For those contemplating their Social Security claiming strategy, I recommend a holistic evaluation. Consider not just the numerical benefits but the broader implications on health, personal happiness, and life experiences. Financial optimization shouldn’t come at the expense of living a fulfilling retirement.

While my experience doesn’t invalidate the potential benefits of delayed claiming for everyone, it serves as a personal reminder that individual circumstances vary greatly. Consulting with financial advisors, understanding personal health trajectories, and maintaining flexibility are crucial in making informed retirement decisions.