As retirement landscapes shift like desert sands, a groundbreaking report is about to upend everything retirees thought they knew about financial sustainability. Imagine a withdrawal strategy so unexpected, it challenges decades of conventional wisdom and could redefine how millions of Americans approach their golden years. In a twist that’s sending tremors through financial planning circles, experts have identified a withdrawal rate that might seem counterintuitive at first glance—a number so surprisingly conservative that it could either be a stroke of genius or a cautionary tale. Buckle up for a deep dive into the financial forecast that’s poised to reshape retirement strategies in 2025, revealing a truth that many might find both alarming and enlightening. Financial experts are sounding the alarm on retirement spending strategies that could potentially derail decades of careful planning. A groundbreaking report reveals a surprisingly conservative approach retirees must adopt to ensure long-term financial stability.

Traditional withdrawal rates of 4% are becoming increasingly obsolete in today’s complex economic landscape. The new recommended rate hovers around 2.8%, representing a dramatic shift in retirement income planning. This substantial reduction reflects growing economic uncertainties, including volatile market conditions, extended life expectancies, and unpredictable healthcare costs.

Retirees who have historically drawn down 4% annually from their investment portfolios may find themselves facing significant financial strain. The lower withdrawal rate demands a complete reimagining of retirement spending strategies, compelling individuals to make more strategic financial decisions.

Factors driving this conservative approach include persistent inflation, market volatility, and the increasing complexity of retirement funding. Experts suggest that seniors must now consider multiple income streams, including Social Security, pension plans, and diversified investment portfolios to maintain financial security.

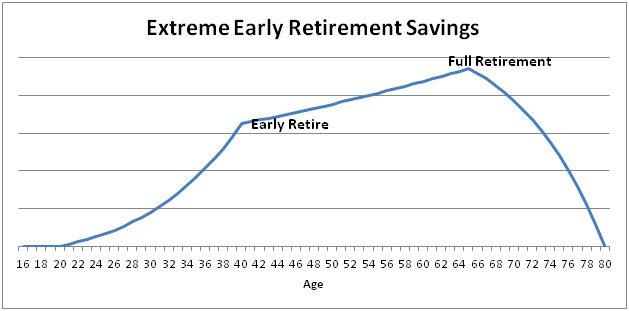

The recommendation doesn’t just impact current retirees but serves as a critical warning for those approaching retirement. Younger professionals are advised to adjust their savings and investment strategies accordingly, potentially increasing contributions and exploring alternative income-generating opportunities.

Investment professionals emphasize the importance of personalized financial planning. While the 2.8% withdrawal rate provides a general guideline, individual circumstances vary significantly. Factors such as personal health, lifestyle preferences, and existing assets play crucial roles in determining optimal withdrawal strategies.

Technology and financial tools are emerging as key resources for retirees navigating this challenging landscape. Advanced retirement calculators and comprehensive financial planning software can help individuals create more nuanced and adaptive income strategies.

The shift also highlights the critical need for continuous financial education and professional guidance. Retirees are encouraged to work closely with financial advisors who can provide tailored advice based on individual circumstances and evolving economic conditions.

Some proactive strategies include maintaining a more aggressive investment approach, exploring part-time work opportunities, and developing multiple passive income sources. Flexibility and adaptability have become essential components of modern retirement planning.

As economic landscapes continue to evolve, retirement strategies must remain dynamic. The 2.8% withdrawal rate represents more than a numerical recommendation—it’s a fundamental reimagining of how Americans approach financial security in their later years.