In the labyrinth of bureaucratic mandates, a new regulatory wave is set to sweep across the American business landscape, challenging companies large and small with an unprecedented insurance requirement. As the federal government unveils a fresh legislative directive that could dramatically reshape corporate risk management, entrepreneurs and executives find themselves standing at a critical crossroads of compliance and financial strategy. This isn’t just another regulatory checkbox—it’s a potential seismic shift that could redefine how businesses protect themselves and their stakeholders in an increasingly complex economic environment. In the ever-evolving landscape of business regulations, a groundbreaking mandate is set to reshape the insurance industry and corporate risk management. This new federal requirement is sending ripples through boardrooms and small business offices alike, forcing companies to reassess their financial protection strategies.

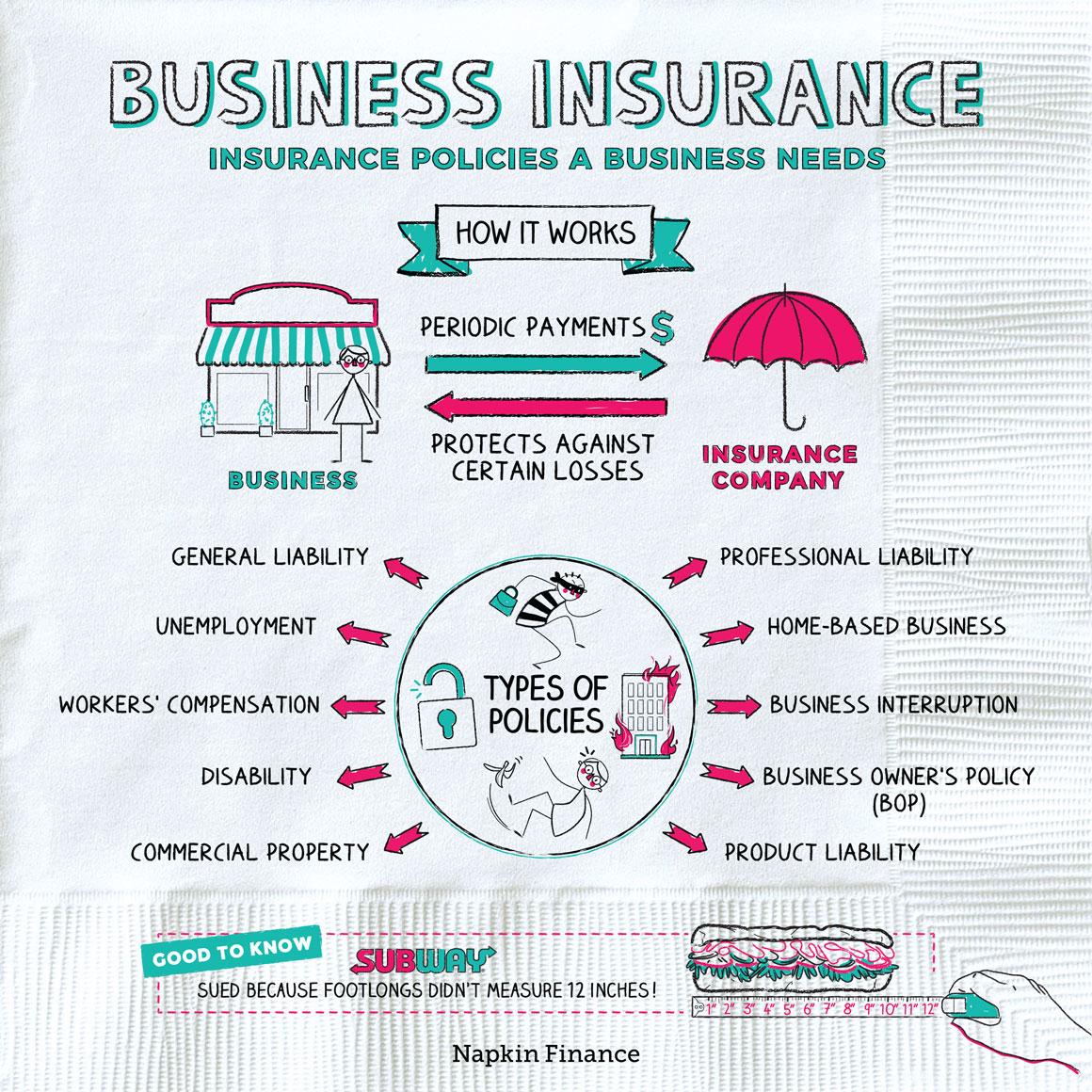

The legislation mandates a comprehensive insurance policy that goes beyond traditional coverage models. Businesses across various sectors will now need to implement a multi-layered risk management approach that addresses emerging technological and societal challenges. Failure to comply comes with substantial financial penalties that could cripple unprepared organizations.

What makes this insurance directive particularly unique is its holistic approach to risk mitigation. Unlike previous one-size-fits-all insurance models, the new requirement takes into account complex modern business ecosystems. Cybersecurity threats, pandemic-related disruptions, and rapidly changing workforce dynamics are now integral considerations in the coverage framework.

Small businesses stand to be the most significantly impacted. The financial burden of implementing this new insurance model could strain already tight budgets, potentially creating a challenging adaptation period. Entrepreneurs and mid-sized companies will need to make strategic financial decisions to absorb these additional compliance costs.

Large corporations, while better equipped to handle the transition, will also face substantial restructuring of their risk management protocols. The comprehensive nature of the mandate requires a complete overhaul of existing insurance strategies, demanding significant investments in assessment and implementation.

Technology plays a crucial role in this regulatory shift. Advanced risk assessment algorithms and predictive modeling are becoming essential tools for businesses seeking to navigate the new insurance landscape. Companies that invest in sophisticated risk evaluation technologies will likely gain a competitive edge in understanding and mitigating potential threats.

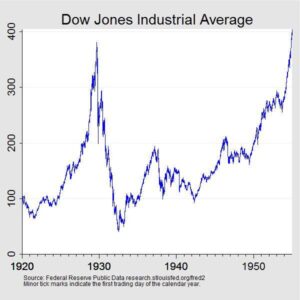

Economic experts predict this mandate will create a ripple effect across multiple industries. Insurance providers will need to develop innovative product offerings, while businesses will be compelled to adopt more proactive risk management approaches. The potential long-term benefits include more resilient business models and enhanced economic stability.

Legal and financial advisors are recommending immediate action. Companies should conduct comprehensive internal assessments, engage with specialized insurance consultants, and develop strategic implementation plans. The timeline for compliance is tight, and organizations that delay could face severe financial consequences.

The broader implications extend beyond immediate compliance. This federal requirement signals a significant shift in how businesses approach risk management, potentially setting new standards for corporate resilience and adaptability in an increasingly complex global marketplace.