Title: The Fall of a Tech Titan: Apple’s Market Cap Meltdown

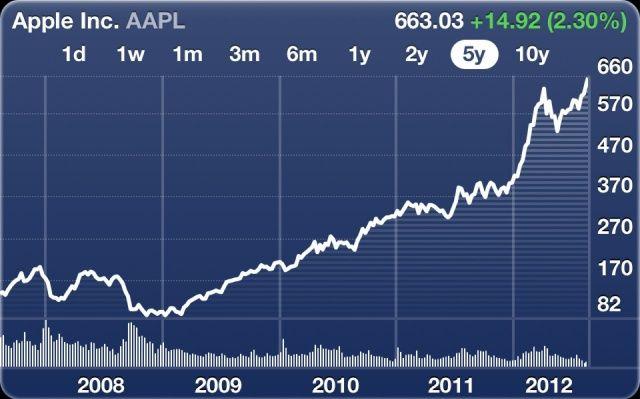

In the high-stakes world of Wall Street, even giants can stumble. Apple,once the undisputed king of technology and innovation,has witnessed a staggering decline that reads like a financial thriller. As its record-breaking market capitalization peak, the tech behemoth has seen nearly $700 billion evaporate into the market’s merciless atmosphere—a sum that would make most companies’ entire valuation look like pocket change.This dramatic descent serves as a stark reminder that in the volatile realm of stock markets, today’s pinnacle can quickly become tomorrow’s valley.In a dramatic turn of events, the tech giant’s market valuation has experienced a seismic shift, sending ripples through the global financial landscape.The precipitous decline reflects a complex interplay of market dynamics, investor sentiment, and emerging technological challenges.

Shareholders have witnessed a staggering erosion of wealth as the company’s stock price tumbled dramatically from its peak. The magnitude of the loss is unprecedented, representing a meaningful markdown that has caught the attention of Wall Street analysts and tech industry observers alike.

Multiple factors have converged to create this perfect storm of market devaluation. Global economic uncertainties, supply chain disruptions, and shifting consumer behaviors have all played critical roles in undermining investor confidence. The tech sector’s recent volatility has exposed vulnerabilities in what was once considered an unassailable market position.

Competitive pressures from emerging smartphone manufacturers and semiconductor challenges have further complicated the company’s growth trajectory. Key product lines that traditionally drove revenue have shown signs of saturation, forcing strategic recalibrations and innovative approaches to maintain market relevance.Institutional investors have been particularly sensitive to these developments, rapidly adjusting their portfolios and triggering cascading sell-offs.The rapid market capitalization reduction highlights the fragility of even the most seemingly robust technology enterprises.

Analysts point to several underlying issues contributing to the stock’s dramatic decline. Concerns about future growth potential, regulatory challenges in key international markets, and increasing competition from both established and emerging technological players have eroded previous optimism.

The company’s leadership has remained relatively measured in its response, emphasizing long-term strategic vision and ongoing innovation initiatives. However, the market’s reaction suggests a growing skepticism about the association’s ability to maintain its historical performance levels.

International market dynamics have further complicated the situation, with geopolitical tensions and economic uncertainties creating additional pressure on technology stocks. The ripple effects extend beyond a single company, potentially signaling broader shifts in the global technology investment landscape.

Investors and market watchers are closely monitoring subsequent developments, attempting to discern whether this represents a temporary correction or a more fundamental change in the technology sector’s economic ecosystem.

The substantial market cap reduction serves as a stark reminder of the volatile nature of technology investments and the constant need for strategic adaptation in an increasingly complex global marketplace.