In the high-stakes chess game of global trade, former President Donald Trump is poised to make a move that could send tremors through financial markets. As speculation mounts about potential reciprocal tariffs, economists and investors find themselves on the edge of their seats, wondering whether the anticipated announcement on April 2nd will be a strategic masterstroke or a disruptive economic wildcard. With tensions simmering and global trade dynamics hanging in the balance, Trump’s latest potential economic intervention promises to be anything but predictable. Financial markets are potentially underestimating the seismic economic implications of former President Donald Trump’s potential policy moves regarding reciprocal tariffs. The impending announcement on April 2nd could represent a meaningful shift in international trade dynamics, sending ripples through global economic landscapes.

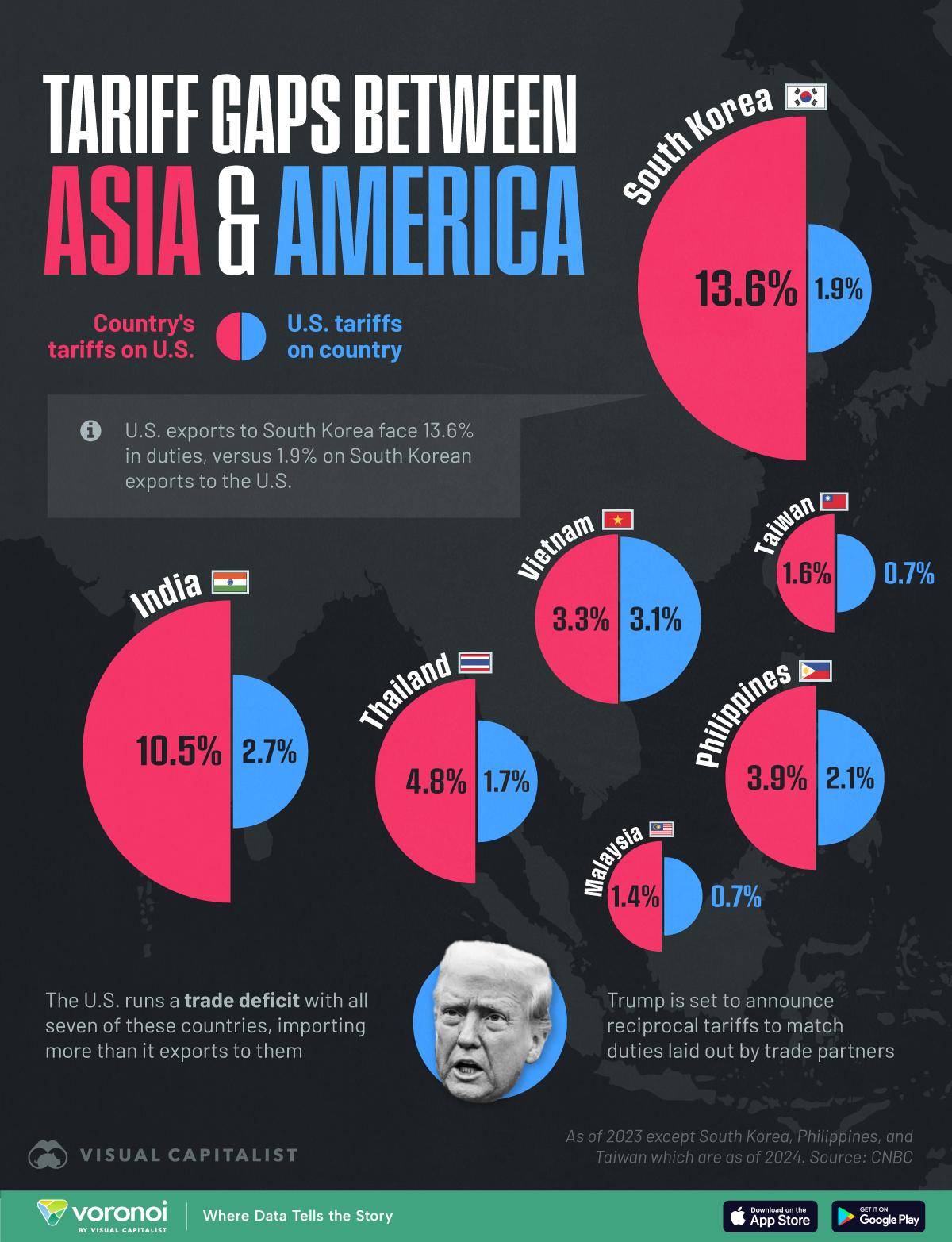

Experts suggest that Trump’s proposed tariff strategy might go beyond conventional trade measures, potentially targeting specific countries with punitive economic measures designed to balance perceived trade inequities. The proposed approach could fundamentally reshape international economic relationships, particularly with major trading partners like China, Mexico, and European Union nations.

Preliminary analysis indicates that Trump’s framework might involve implementing steep tariff rates—potentially ranging from 30% to 60%—on imports from countries deemed unfair in their trading practices. This strategy would represent a dramatic departure from traditional diplomatic trade negotiations, leveraging economic pressure as a primary geopolitical tool.

Economic analysts are closely monitoring potential market reactions, recognizing that such aggressive tariff policies could trigger immediate volatility in currency exchanges, stock markets, and commodity pricing. The proposed measures might create unprecedented challenges for multinational corporations heavily dependent on global supply chains.

Investment strategists warn that current market valuations might not fully incorporate the potential disruptions these tariff policies could generate. The complex interconnectedness of global trade means that retaliatory measures from affected countries could quickly escalate, creating a cascade of economic uncertainties.

Sectors most likely to experience immediate impact include automotive manufacturing, technology hardware, industrial machinery, and agricultural commodities. Companies with significant international exposure might need to rapidly recalibrate their strategic planning to mitigate potential financial risks.

The potential tariff announcement represents more than a mere economic policy adjustment—it signals a potentially transformative approach to international trade relationships. By emphasizing reciprocity and economic nationalism, the proposed strategy challenges existing multilateral trade frameworks.

Market participants are advised to maintain heightened awareness and flexibility, as the April 2nd announcement could introduce considerable unpredictability into global economic calculations. Elegant investors might need to develop nuanced hedging strategies to navigate potential market turbulence.

The economic landscape stands at a critical juncture, with Trump’s potential tariff policy representing a pivotal moment in contemporary international trade dynamics. Financial markets must prepare for a potentially disruptive recalibration of established economic relationships and trading protocols.