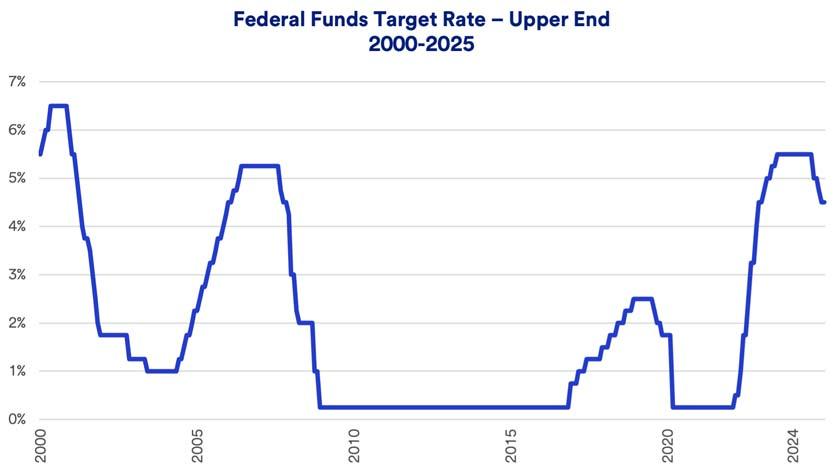

As the economic landscape continues to shift like sand beneath our feet, financial pundits and Federal Reserve watchers are peering into their crystal balls, attempting to decode the intricate dance of monetary policy. The year 2025 looms on the horizon, promising potential interest rate adjustments that could reshape investment strategies, housing markets, and personal financial planning. With whispers of potential rate cuts growing louder, experts are parsing every nuanced statement from Fed officials, seeking clues about the central bank’s future moves. This article delves into the complex web of predictions, economic indicators, and expert opinions that might illuminate the path of monetary policy in the near future. As economic forecasters peer into the near future, the Federal Reserve’s monetary policy trajectory remains a topic of intense speculation. Analysts from major financial institutions are parsing through economic indicators, employment data, and inflation trends to gauge potential interest rate movements.

Leading economists suggest the central bank may adopt a cautious approach, with potential rate cuts contingent upon sustained economic stability. Morgan Stanley’s research team predicts a measured reduction of 75 to 100 basis points by late 2025, emphasizing the need for continued inflation moderation.

Goldman Sachs strategists argue that economic resilience could prompt more conservative rate adjustments. Their models indicate a potential two to three incremental cuts,primarily targeting economic stimulation without risking inflationary pressures.

Investment strategists at JPMorgan Chase highlight technological advancements and shifting labor market dynamics as critical factors influencing Fed decisions. Automation and artificial intelligence are expected to play significant roles in productivity measurements that could sway monetary policy.

Regional economic variations might complicate nationwide rate cut strategies. Sunbelt states experiencing robust growth could experience different monetary policy impacts compared to industrial Midwest regions facing technological disruption.Emerging market interconnectedness adds complexity to domestic rate cut predictions.Global economic shifts, especially in China and emerging technology sectors, could substantially influence the Federal Reserve’s decision-making calculus.

Cryptocurrency and digital asset markets remain wild cards in economic forecasting. Some economists suggest these alternative financial instruments might introduce unprecedented variables into traditional monetary policy calculations.

Climate change adaptation and green infrastructure investments could also indirectly influence rate cut strategies. The potential economic transformations resulting from sustainability initiatives might create unexpected monetary policy considerations.Consumer spending patterns, dramatically reshaped by pandemic experiences, continue to challenge traditional economic modeling. Remote work trends, evolving consumption habits, and generational financial preferences will likely factor into Fed deliberations.

Risk management remains paramount.Federal Reserve officials will meticulously evaluate potential economic scenarios, balancing stimulative rate cuts against inflationary risks and maintaining overall economic stability.Technological innovation,geopolitical developments,and unforeseen global events could rapidly transform economic predictions. Flexibility and adaptive strategy will be crucial for policymakers navigating the complex financial landscape of 2025.

As uncertainty persists, financial experts emphasize the importance of continuous monitoring and nuanced interpretation of emerging economic signals. The Federal Reserve’s rate cut strategy will ultimately reflect a delicate balance between stimulating economic growth and maintaining long-term fiscal prudence.