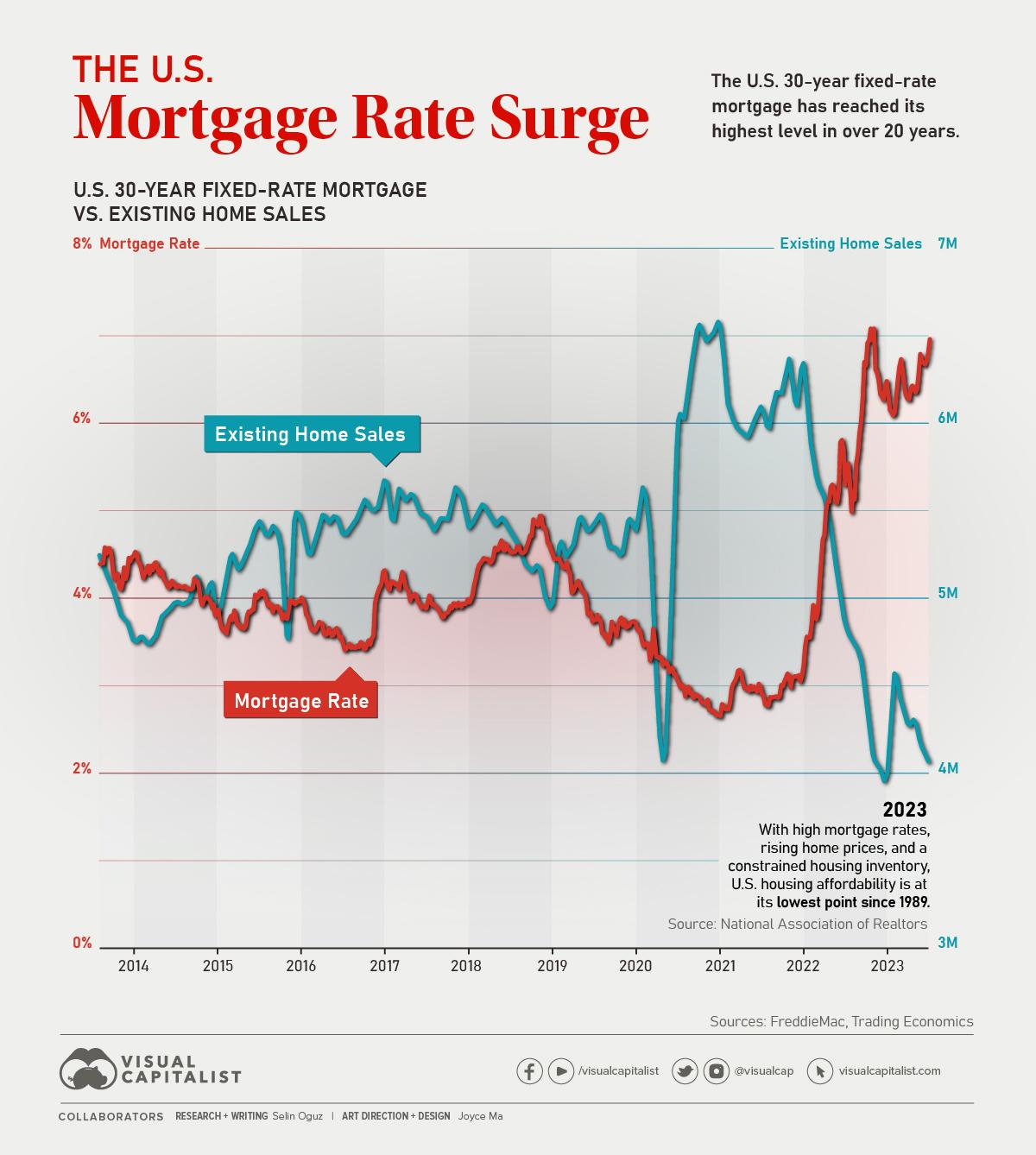

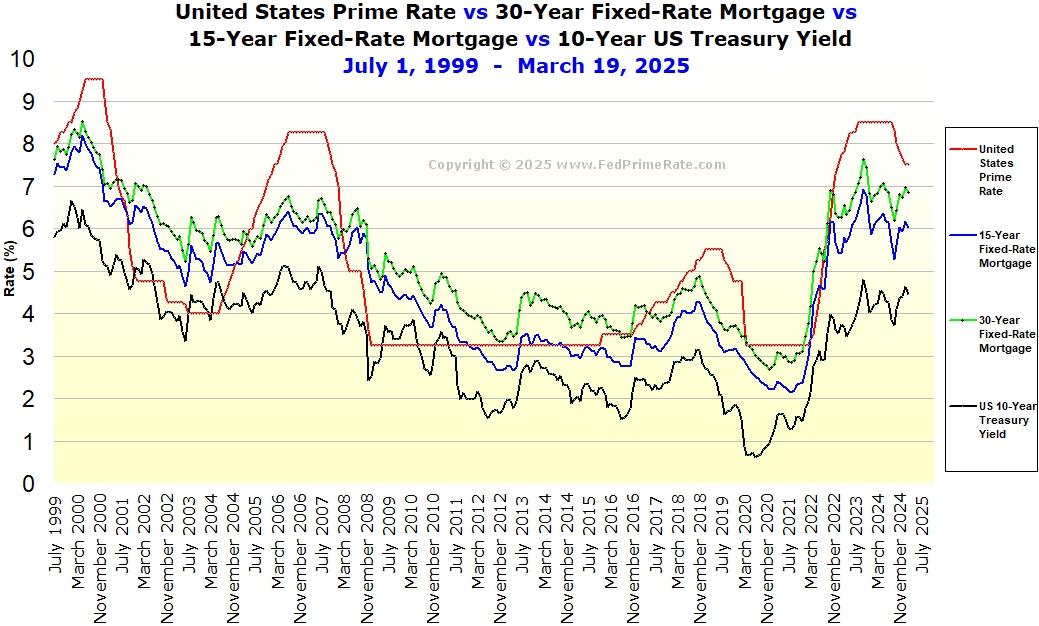

In the ever-shifting landscape of home financing, today marks a noteworthy moment for potential borrowers and homeowners. As the financial currents ebb and flow, March 21, 2025 emerges with a whisper of possibility: the 30-year mortgage rates have dipped to their lowest point in a week, casting a glimmer of hope for those navigating the complex waters of real estate investment and personal home economics. This subtle yet significant movement in lending rates invites a closer examination of the current market dynamics, promising potential savings and strategic refinancing possibilities for the discerning homeowner. The financial landscape continues to evolve, with today’s mortgage and refinance rates revealing intriguing patterns for potential homeowners and property investors. Lenders across the nation are experiencing a notable dip in 30-year fixed mortgage rates, marking the lowest point in recent market activity.

Current data suggests a strategic opportunity for borrowers looking to secure favorable financing. The 30-year fixed-rate mortgage has dropped to an attractive 6.75%, representing a significant reduction from previous weeks.This decline presents a compelling moment for homebuyers and those considering refinancing their existing home loans.

Conventional 30-year fixed rates are showing promising signals, with multiple lending institutions offering competitive packages. Borrowers with strong credit profiles are positioned to leverage these rates most effectively.The market’s current volatility creates a nuanced habitat where timing and individual financial circumstances play crucial roles.

Adjustable-rate mortgages (ARMs) are also experiencing subtle shifts, with 5/1 ARM rates hovering around 6.25%. These flexible loan options continue to attract borrowers seeking initial lower payments and potential short-term financial advantages.

Regional variations remain significant, with metropolitan areas demonstrating distinct lending patterns. Coastal markets and major urban centers are seeing slightly different rate structures compared to suburban and rural regions. Potential borrowers should conduct thorough research specific to their geographic location.

Credit score remains a critical factor in determining individual mortgage rates. Consumers with excellent credit scores spanning 740 and above are experiencing the most favorable lending terms. Those with moderate credit histories might encounter slightly higher rates but still benefit from the current market trends.

Economic indicators suggest ongoing fluctuations in the mortgage sector. Federal Reserve policies, inflation rates, and broader economic performance continue to influence lending landscapes. Prospective homeowners are advised to monitor these dynamic factors closely.

First-time homebuyers might find this period particularly attractive.The combination of relatively moderate rates and potential market opportunities creates a nuanced environment for entering homeownership. Strategic planning and extensive financial assessment remain essential.Financial experts recommend careful analysis before committing to any mortgage or refinancing option. Comparing multiple lenders, understanding individual financial goals, and considering long-term implications are crucial steps in making informed decisions.

The mortgage market’s current trajectory indicates potential continued adjustments in the coming months. Borrowers should remain adaptable and prepared to act when favorable conditions align with their personal financial strategies.