In the labyrinth of investment strategies, value investing stands as a beacon of pragmatic wisdom, guiding investors through turbulent market landscapes. Imagine uncovering a hidden gem—a stock that whispers promises of intrinsic worth, waiting to be recognized by the discerning eye of a true value investor. As markets fluctuate and trends rise and fall, one particular stock emerges from the shadows, presenting a compelling narrative that could redefine your investment portfolio. This isn’t just another stock pick; it’s a potential gateway to understanding the nuanced art of value investing, where patience meets opportunity, and strategic thinking trumps fleeting market sentiment. In the realm of value investing, discerning investors are constantly seeking opportunities that offer substantial growth potential at a reasonable price. One standout candidate that demands attention is a company that has consistently demonstrated resilience, strategic positioning, and a compelling financial narrative.

This particular stock represents more than just a numerical entry in a portfolio; it embodies a strategic investment philosophy rooted in fundamental analysis and long-term potential. With a robust business model that transcends short-term market fluctuations, the company has established itself as a beacon of stability in an increasingly volatile economic landscape.

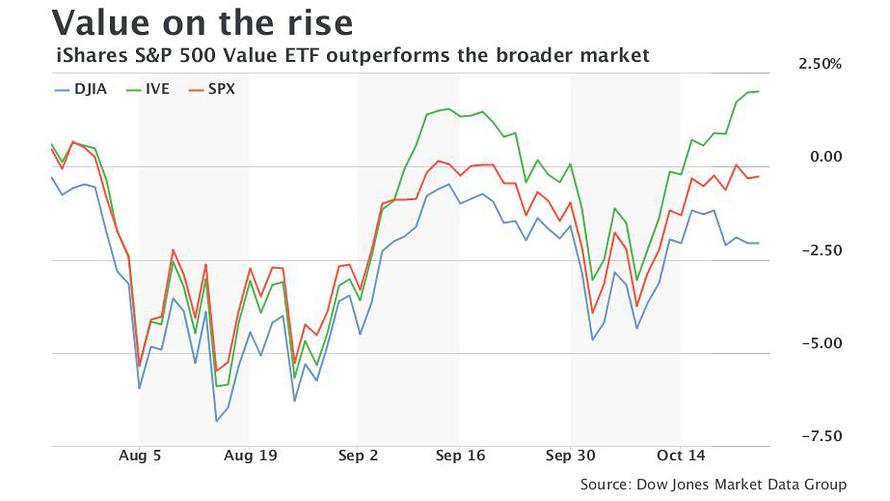

Financial metrics reveal a compelling story of sustained performance. The company’s price-to-earnings ratio suggests significant undervaluation compared to industry peers, presenting an attractive entry point for astute investors. Consistent revenue growth, coupled with disciplined cost management, indicates a management team capable of navigating complex market dynamics.

Critical to its investment appeal is the company’s diversified revenue streams. Unlike single-sector enterprises vulnerable to market shifts, this organization has strategically developed multiple income channels that provide insulation against sector-specific downturns. This approach minimizes risk while maximizing potential returns.

Technological innovation plays a pivotal role in the company’s competitive advantage. Substantial investments in research and development demonstrate a forward-thinking strategy, positioning the organization to capitalize on emerging market trends. The ability to adapt and evolve is increasingly becoming a critical determinant of long-term success.

Dividend performance adds another layer of attractiveness. With a history of consistent and growing dividend payouts, the stock offers investors a reliable income stream alongside potential capital appreciation. This dual benefit aligns perfectly with value investing principles of generating sustainable returns.

Macroeconomic trends further support the investment thesis. The company operates in a sector poised for significant growth, with expanding market opportunities and increasing global demand. Regulatory environments and industry dynamics suggest a favorable trajectory for future expansion.

Potential risks exist, as with any investment. However, comprehensive analysis reveals that the company’s strong balance sheet, strategic positioning, and management expertise provide substantial mitigation mechanisms. Thorough due diligence remains paramount for investors considering this opportunity.

For value investors seeking a balanced, potentially lucrative investment, this stock represents a compelling option. Its combination of financial strength, strategic positioning, and growth potential offers an attractive proposition in today’s complex investment landscape.