The Sunshine State is experiencing a real estate rollercoaster that’s leaving homeowners and investors scratching their heads. Florida’s housing market is suddenly awash with unsold properties, creating a landscape where ’For Sale’ signs seem to multiply like summer thunderstorms. Behind this unexpected surge lies a complex narrative of economic shifts and regional dynamics that are reshaping the state’s traditional property paradigm. What’s driving this unprecedented accumulation of homes, and what does it mean for potential buyers, sellers, and the broader economic ecosystem? Two compelling factors are emerging as key protagonists in this unfolding real estate drama. The Sunshine State’s real estate landscape is experiencing a seismic shift that’s catching both homeowners and investors off guard. A perfect storm of economic factors is transforming Florida’s once-scorching housing market into a dramatically different environment.

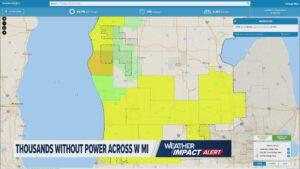

Insurance costs have become a nightmare for homeowners, skyrocketing to unprecedented levels that are pushing potential buyers to the sidelines. Massive insurance premiums, driven by increased hurricane risks and substantial property damage claims from recent storms, are creating a significant barrier to homeownership. Some residents are seeing annual insurance rates jump by 50% or more, effectively pricing out middle-class families from purchasing homes in coastal and high-risk areas.

Climate change is playing a substantial role in reshaping Florida’s real estate dynamics. Insurers are reassessing risk models, with many companies either drastically increasing rates or completely withdrawing from certain regions. Citizens Property Insurance, the state-backed insurer, has become the last resort for many homeowners, signaling a critical market disruption that’s sending shockwaves through the housing ecosystem.

Economic uncertainty is the second major factor contributing to the housing market slowdown. Rising interest rates have dramatically reduced purchasing power, making mortgages significantly more expensive. Potential buyers who were previously eager to enter the market are now hesitating, creating a bottleneck of unsold properties.

The median home price in Florida has experienced a notable cooling trend, with some metropolitan areas seeing price reductions of 10-15% compared to peak pandemic levels. This shift is particularly pronounced in markets like Miami, Tampa, and Orlando, where real estate once seemed immune to traditional market fluctuations.

Investors and homeowners are finding themselves in an unexpectedly challenging environment. Properties that would have been snapped up within days during the pandemic are now lingering on the market for months. The rapid appreciation of home values has ground to a halt, and in some cases, reversed.

Local real estate agents are adapting to this new landscape, developing more creative marketing strategies and offering more flexible terms to attract potential buyers. Some are implementing price reductions, offering closing cost assistance, or providing temporary rate buydown options to entice hesitant purchasers.

The current market represents a significant departure from the frenzied buying environment of 2020-2021. Buyers now have more negotiating power, and the days of bidding wars and instant offers have become a distant memory. As Florida’s housing market continues to recalibrate, both sellers and potential buyers must navigate this complex and evolving terrain with careful consideration and strategic planning.