In the high-stakes arena of automotive manufacturing, Tata Motors finds itself navigating treacherous economic currents. As global markets sway and competition intensifies, the Indian automotive giant confronts a stark reality: a important quarterly profit decline that reflects deeper industry challenges. With tariff pressures squeezing margins and sluggish sales casting long shadows over performance, the company’s financial landscape reveals a complex narrative of resilience and adaptation in an increasingly unpredictable market. In a stark revelation of the challenges facing the automotive industry, Tata Motors has reported a significant downturn in its quarterly financial performance, reflecting the complex economic landscape and market pressures. The company’s profitability has taken a substantial hit,driven by a combination of strategic headwinds and competitive market dynamics.

Recent financial statements demonstrate a sharp decline in net profit, underscoring the mounting challenges confronting the Mumbai-based automotive manufacturer. Tariff complications and sluggish sales volumes have emerged as primary contributors to the company’s financial strain, creating a complex operational environment that demands strategic recalibration.

The automotive sector’s intricate ecosystem has been especially unforgiving, with global supply chain disruptions and fluctuating raw material costs exacerbating existing market pressures. Tata Motors’ diverse portfolio, spanning commercial and passenger vehicles, has not been immune to these systemic challenges.

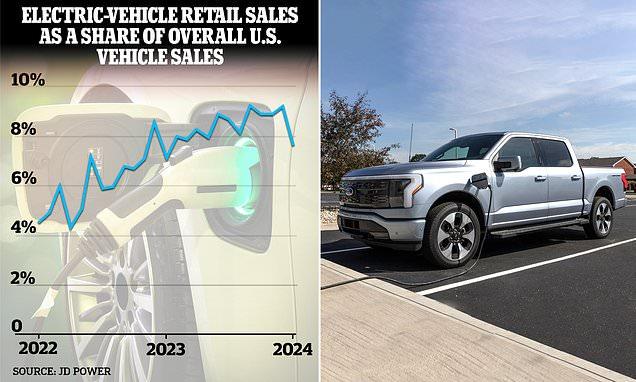

Market analysts suggest that the slowdown stems from multiple interconnected factors, including reduced consumer spending, increasing competition, and the ongoing transition toward electric and enduring mobility solutions.The company’s strategic positioning in both conventional and emerging vehicle segments has been tested by these multifaceted market dynamics.

Domestic and international market segments have contributed differently to the company’s performance, with varying levels of resilience and vulnerability. The commercial vehicle division, traditionally a robust revenue generator, has experienced notable fluctuations, reflecting broader economic uncertainties.

Operational strategies are now under intense scrutiny, with leadership potentially considering aggressive cost-management approaches and portfolio optimization to mitigate the current financial pressures. Investments in technology, innovation, and manufacturing efficiency could represent potential pathways toward recovery and sustainable growth.

The electric vehicle segment remains a potential luminous spot, with increasing consumer interest and governmental support for sustainable transportation solutions. Tata Motors’ strategic investments in this emerging market could provide a counterbalance to current challenges.

Investor sentiment has been notably impacted, with stock market reactions reflecting concerns about the company’s near-term financial trajectory. The automotive manufacturer will likely need to demonstrate clear strategic direction and operational resilience to restore market confidence.

Comprehensive restructuring efforts, potential product line adjustments, and enhanced operational efficiencies might emerge as critical strategies in navigating the current complex market landscape. The company’s ability to adapt, innovate, and respond swiftly to changing market conditions will be paramount in determining its future performance and competitive positioning.