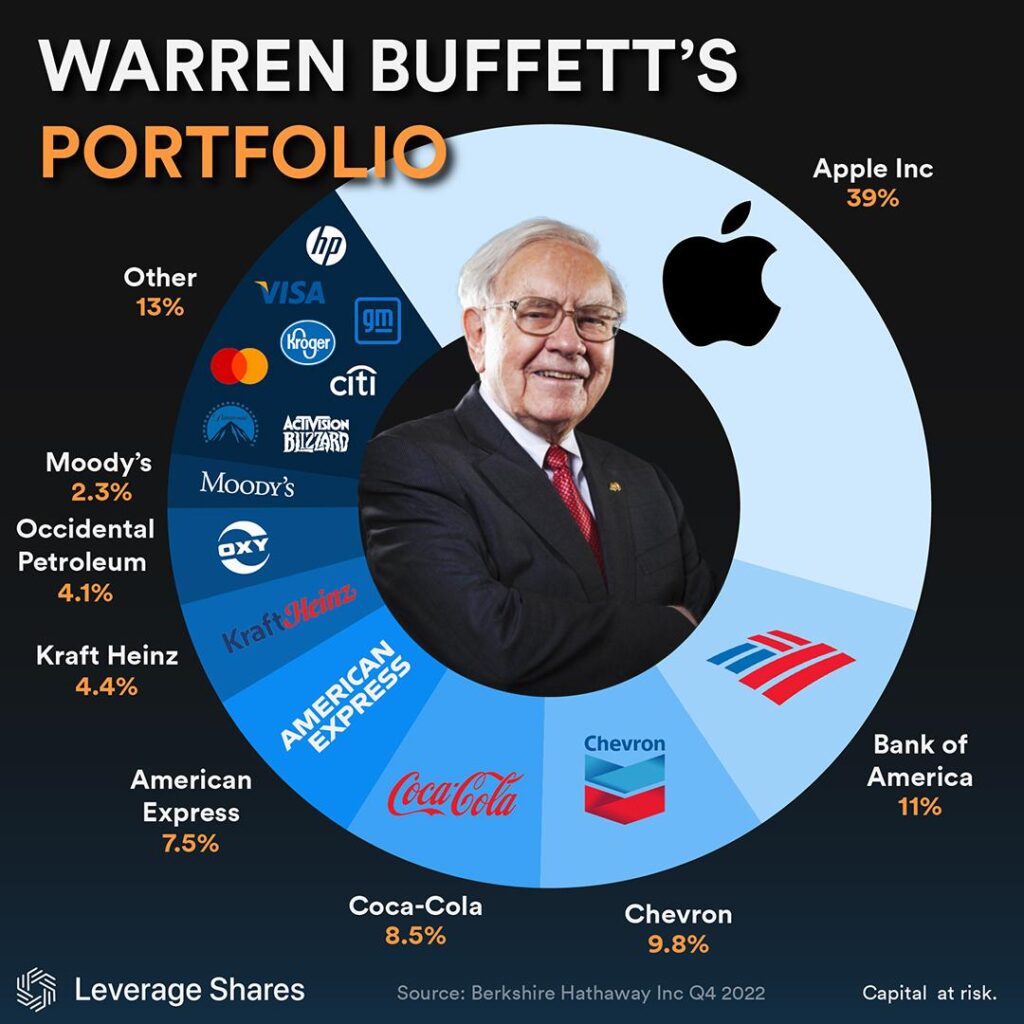

In the high-stakes world of investment, Warren Buffett has long been known for his maverick approach, zigging where others zag and finding value in unexpected places. This time, the Oracle of Omaha has turned his discerning eye away from customary banking giants like JPMorgan and Wells Fargo, instead placing a strategic $459 million bet on an asset that has Wall Street whispering and investors leaning in with curiosity. As the financial landscape shifts and trembles, Buffett’s latest move signals a potential glimpse into the future of smart investing—a calculated risk that could redefine portfolio strategies for years to come.In a strategic move that has caught the attention of Wall Street, the legendary investor has made a significant investment that diverges from traditional banking stocks. This unexpected shift highlights Buffett’s keen eye for emerging opportunities in the financial landscape.

The investment in question centers on a unique asset class that represents a departure from his historically conservative portfolio. By allocating $459 million,Buffett demonstrates his willingness to explore alternative investment strategies that challenge conventional wisdom.

Recent financial reports reveal the nuanced approach taken by Berkshire Hathaway’s leadership. Instead of doubling down on traditional banking giants like JPMorgan Chase and Wells Fargo, the investment firm has strategically positioned itself in a sector that promises potential growth and stability.

Market analysts suggest this move reflects a deep understanding of evolving economic dynamics. The chosen asset represents a calculated bet on future financial trends, showcasing Buffett’s legendary ability to identify undervalued opportunities before they become mainstream.

The investment strategy goes beyond mere speculation.It represents a calculated risk that aligns with Berkshire Hathaway’s long-standing approach of identifying fundamental value and long-term potential. By steering clear of established banking institutions, Buffett signals a potential shift in how institutional investors might view financial assets.

This decision comes at a time when the banking sector faces unprecedented challenges, including regulatory pressures, technological disruption, and changing consumer behaviors.The $459 million allocation suggests a forward-thinking approach that considers broader economic trends beyond traditional financial metrics.

Interestingly, the asset in question has demonstrated resilience and potential for growth that traditional banking stocks might currently lack. This strategic move underscores Buffett’s reputation for making counterintuitive investment decisions that often prove prescient in the long run.

The investment community remains intrigued by this growth, with many experts analyzing the potential implications of this significant allocation. It serves as a reminder that even after decades in the investment world, Buffett continues to surprise and challenge established market narratives.

Market watchers are closely monitoring how this investment will perform, recognizing that Buffett’s decisions often carry significant weight in the financial ecosystem. The move represents more than just a financial transaction; it’s a statement about potential emerging opportunities in an increasingly complex economic landscape.

As investors and analysts continue to dissect this strategic decision, one thing remains clear: Warren Buffett’s investment ideology continues to evolve, demonstrating an remarkable ability to adapt and identify value in unexpected places.

Buffett: This year’s stock market turmoil ‘is really nothing’