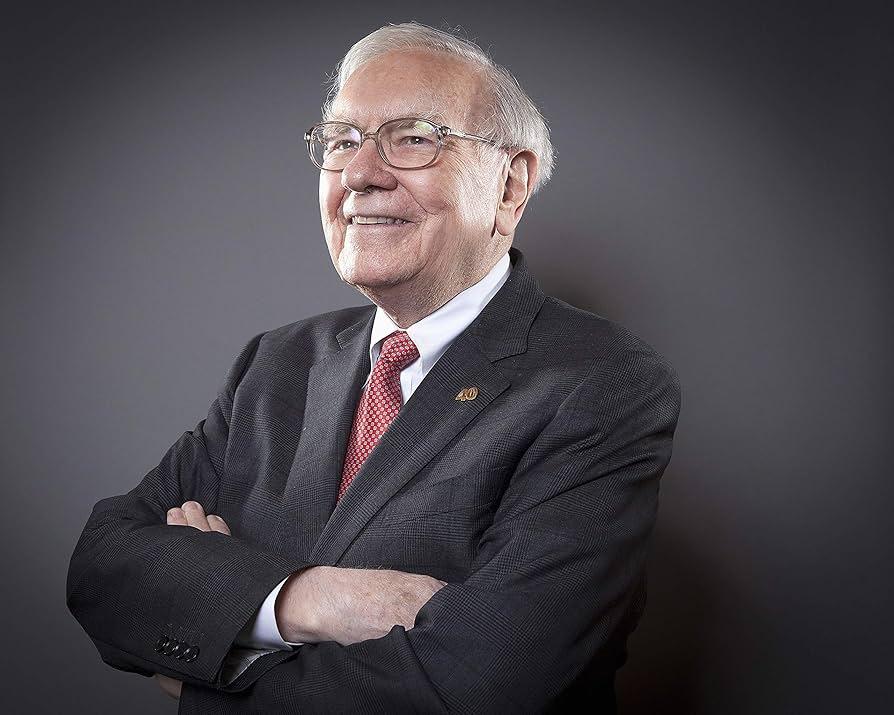

In the high-stakes arena of American finance, Warren Buffett emerges once again as a prophetic voice, his words echoing through the marble halls of Washington while Berkshire Hathaway’s balance sheet speaks volumes. As the legendary investor’s conglomerate announces a staggering record profit and a mountain of cash reserves, Buffett’s cautionary message cuts through the economic noise like a sharp investment scalpel, challenging policymakers to listen and learn from the wisdom of Wall Street’s most celebrated oracle.Berkshire Hathaway’s recent financial report reveals more than just extraordinary numbers; it reflects a critical message from one of America’s most respected investors. Warren Buffett’s annual shareholder letter serves as a potent wake-up call to policymakers in Washington, highlighting the complex economic landscape and potential challenges ahead.

The legendary investor’s commentary goes beyond mere financial reporting,signaling potential systemic risks that could impact the nation’s economic stability.With Berkshire’s cash reserves swelling to an unprecedented $167 billion, Buffett’s strategic positioning suggests a cautious outlook on current market conditions and potential economic headwinds.

Buffett’s warning resonates with deeper concerns about fiscal policy, government spending, and long-term economic strategies. His meticulous approach to capital allocation demonstrates a nuanced understanding of economic cycles that many politicians might overlook. The record profits and considerable cash reserves aren’t just a testament to Berkshire’s financial prowess but also a strategic buffer against potential economic uncertainties.

The massive cash stockpile represents more than just financial strength; its a strategic signal about market complexity and potential investment opportunities. Buffett’s historical approach of maintaining significant liquidity during uncertain times has proven prescient in previous economic downturns.

This financial report underscores the disconnect between Wall Street’s performance and the broader economic challenges facing the United States.While corporate profits continue to impress, underlying economic tensions persist, ranging from inflation concerns to global geopolitical uncertainties.

Berkshire’s diversified portfolio, spanning industries from insurance to energy and consumer goods, provides a complete view of economic trends.Buffett’s insights offer a pragmatic perspective that transcends typical political rhetoric, emphasizing structural economic challenges that require elegant, long-term solutions.

the accumulation of such substantial cash reserves signals a strategic pause, suggesting Buffett sees limited attractive investment opportunities in the current market landscape. This conservative approach contrasts with more aggressive investment strategies, reflecting a measured response to complex economic signals.

Washington policymakers would be wise to pay close attention to these subtle yet significant indicators. Buffett’s track record of economic prediction and strategic insight has consistently demonstrated remarkable accuracy,making his current stance a critical data point for understanding potential economic trajectories.The intersection of corporate performance, strategic cash management, and macroeconomic policy creates a complex narrative that extends far beyond simple financial reporting. Buffett’s warning serves as a sophisticated call for prudent economic management and strategic long-term planning.