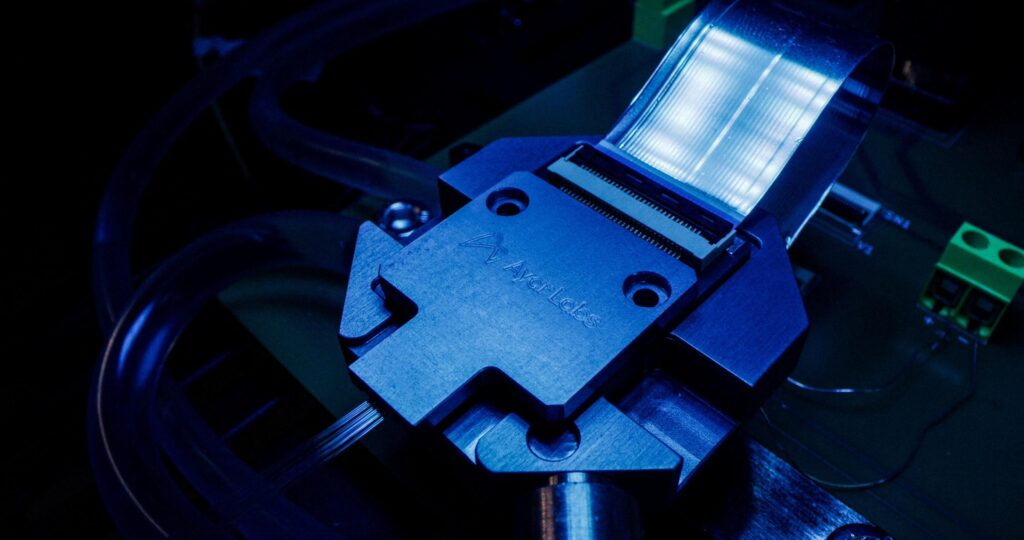

In the relentless pursuit of computing supremacy, scientists in China have unleashed a technological marvel that could rewrite the rules of digital processing. By harnessing the ethereal power of light instead of customary electrical signals, researchers have engineered a breakthrough chip operating at an astonishing 100 GHz, potentially catapulting computational speeds into uncharted territories. This photonic innovation not only shatters existing speed records but also hints at a future where silicon might bow to the luminous potential of optical computing. In a groundbreaking leap for computing technology, researchers at Tsinghua University have unveiled a revolutionary photonic chip that promises to redefine computational speed and efficiency. The breakthrough technology harnesses light waves instead of traditional electrical signals, achieving an unprecedented 100 GHz operational frequency that leaves conventional semiconductor designs in the technological dust.

Unlike traditional computing architectures that rely on electron movement through silicon pathways, this innovative chip utilizes optical wavelengths to transmit and process facts. The fundamental shift from electrical to photonic signaling represents a quantum jump in computational potential, offering dramatically reduced energy consumption and exponentially faster data transfer rates.

Advanced nanophotonic engineering enables the chip to manipulate light waves with remarkable precision, creating microscopic channels that guide optical signals with minimal signal degradation. The intricate design incorporates specialized metamaterials and advanced waveguide structures that allow unprecedented signal integrity at extremely high frequencies.

Experimental results demonstrate the chip’s extraordinary capabilities, with data transmission speeds that eclipse current technological limitations. By eliminating electrical resistance and electromagnetic interference,the photonic architecture achieves computational performance previously considered unfeasible in traditional semiconductor frameworks.The breakthrough carries profound implications across multiple technological domains, from artificial intelligence and machine learning to telecommunications and quantum computing. Potential applications span advanced scientific research, complex computational modeling, and next-generation digital infrastructure.

Scientists involved in the project emphasize that this growth represents more than incremental technological progress—it signifies a fundamental reimagining of computational principles. The ability to process information using light instead of electricity opens unprecedented pathways for technological innovation.

Materials science played a crucial role in developing these advanced photonic circuits. Sophisticated fabrication techniques involve precision-engineered silicon compounds and novel optical metamaterials that can manipulate light waves with extraordinary accuracy. Each nanoscale component represents a meticulously designed interface optimized for maximum signal transmission efficiency.

While commercial deployment remains on the horizon,the research team remains optimistic about scaling the technology. Ongoing refinements aim to enhance signal stability, reduce manufacturing complexity, and improve overall system integration potential.

This landmark achievement underscores China’s growing prominence in cutting-edge technological research, positioning the nation at the forefront of next-generation computing technologies. The photonic chip stands as a testament to human ingenuity, demonstrating how fundamental reimaginings of technological principles can unlock transformative computational capabilities.