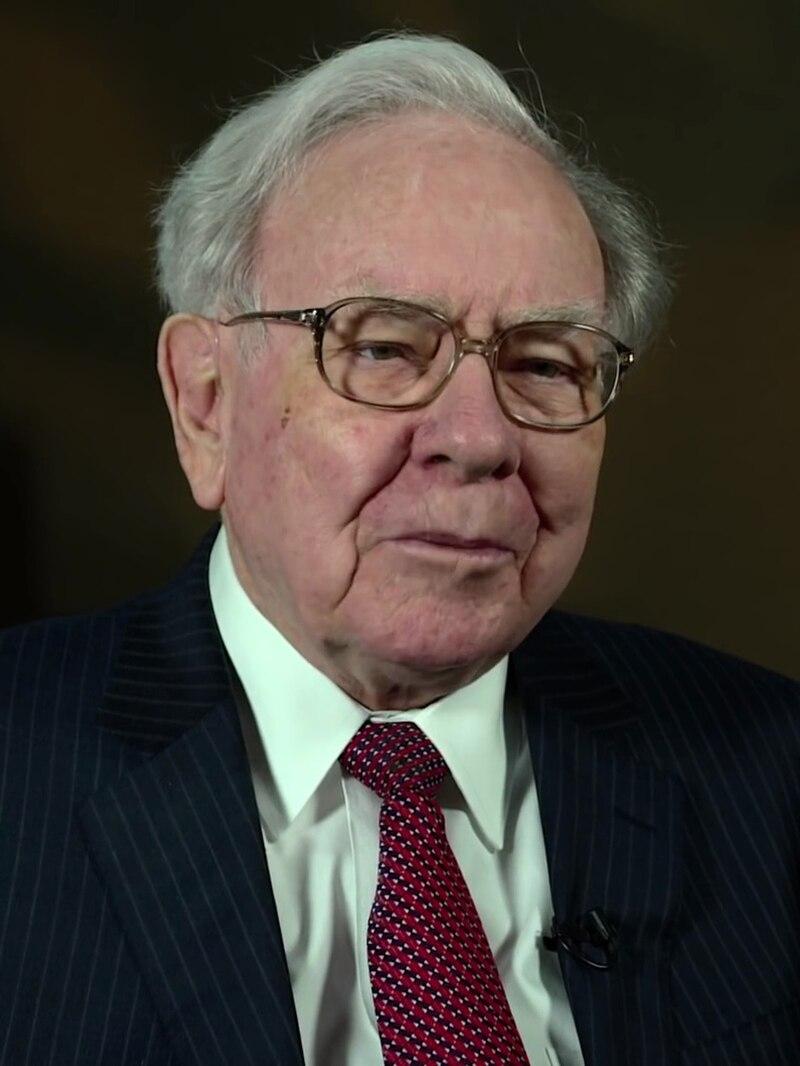

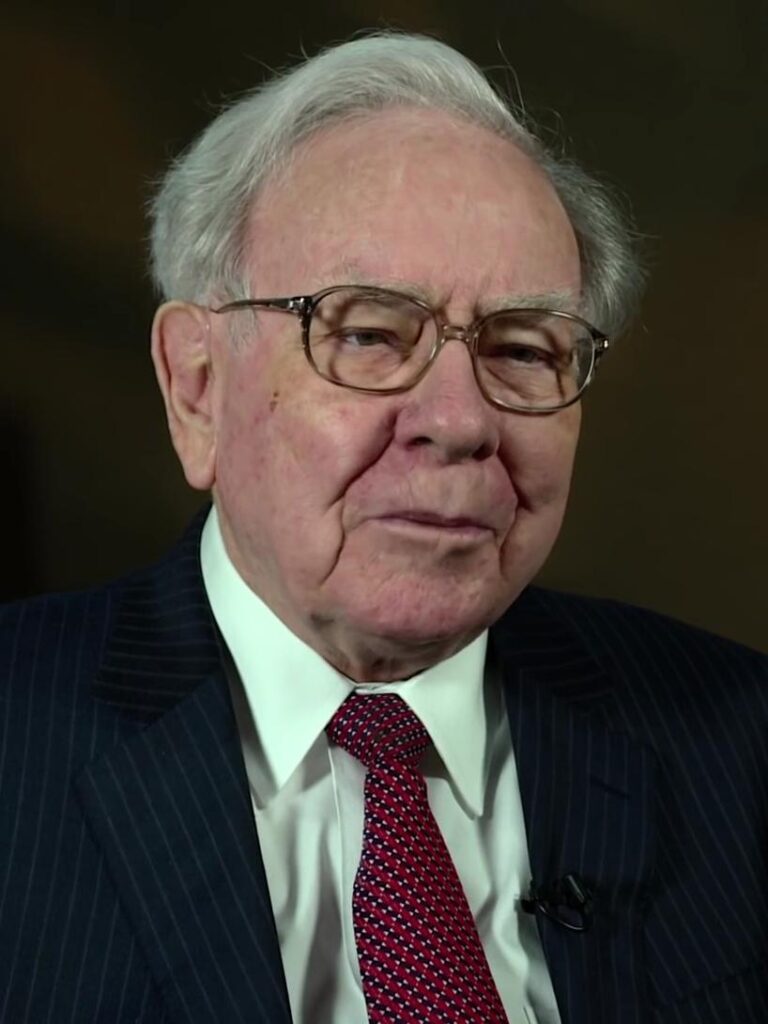

In the high-stakes world of financial wizardry, where fortunes rise and fall with the blink of an algorithmic eye, Warren Buffett has once again demonstrated why he’s known as the Oracle of Omaha. Recent market movements have sent ripples of admiration through the digital landscape, as investors and spectators alike marvel at Buffett’s seemingly prescient timing in divesting key holdings. The internet buzzes with a mixture of respect and wonder, analyzing every nuanced detail of his latest strategic financial maneuver that appears to have captured the perfect economic moment with surgical precision. In a strategic move that has captured the financial world’s attention, the legendary investor has once again demonstrated his unparalleled market insight by executing a precisely timed exit strategy. Warren Buffett’s Berkshire Hathaway recently revealed a notable reduction in its investment portfolio,sparking widespread discussion and admiration among market watchers and investment professionals.

The billionaire’s latest maneuver involves substantial cash reallocation, showcasing his renowned ability to navigate complex market landscapes with remarkable precision. By trimming positions in several high-profile stocks, Buffett has effectively positioned his conglomerate to capitalize on potential future opportunities while protecting existing gains.

Analysts are notably impressed by the timing of these strategic divestments. The move comes at a moment when market volatility and economic uncertainties are creating significant challenges for investors. Buffett’s approach highlights his long-standing beliefs of maintaining substantial cash reserves and being prepared to strike when remarkable opportunities emerge.

Key observations from the recent portfolio adjustments reveal a nuanced understanding of current market dynamics. The Oracle of Omaha has seemingly anticipated potential market corrections by reducing exposure to certain sectors while maintaining a flexible investment stance. This approach has consistently distinguished Buffett from many contemporary investors who often react impulsively to short-term market fluctuations.

Social media and financial platforms have been buzzing with discussions about the implications of these strategic moves. Investment enthusiasts are dissecting every detail,attempting to glean insights from Buffett’s decision-making process. The transparency of Berkshire Hathaway’s reporting allows investors to understand and perhaps learn from these high-level investment strategies.

The cash-out strategy demonstrates Buffett’s continued relevance in an increasingly complex financial ecosystem. Despite technological disruptions and emerging investment paradigms, his fundamental principles of value investing and disciplined capital allocation remain remarkably effective.Financial experts are particularly noting the calculated nature of these portfolio adjustments. The ability to generate liquidity while maintaining a strong investment position reflects decades of accumulated market wisdom. Buffett’s approach serves as a masterclass in risk management and strategic financial planning.

The broader market impact of these moves extends beyond Berkshire Hathaway’s immediate financial performance. Such strategic decisions by a globally respected investor can potentially influence market sentiment and investment strategies across various sectors and institutional investors.

As discussions continue, one thing remains clear: Warren Buffett’s investment acumen continues to captivate and inspire both seasoned professionals and emerging investors worldwide.