In the complex landscape of financial survival, a looming shadow threatens the delicate economic balance of over one million Social Security beneficiaries. As July 24 approaches, a massive garnishment wave is set to crash into the lives of vulnerable citizens, potentially disrupting the already fragile lifelines of retirement and disability income. This impending financial squeeze raises critical questions about individual rights,legal protections,and the strategies that can shield hard-earned benefits from unexpected seizure. What if there were legitimate pathways to navigate this treacherous terrain? What if knowledge could be the ultimate defence against financial vulnerability? This article peels back the layers of Social Security garnishment, offering insights, strategies, and hope for those standing at the precipice of potential fiscal disruption. The upcoming garnishment wave threatens to impact millions of Americans receiving government benefits, creating notable financial stress for vulnerable populations. Starting July 24, over 1,000,000 beneficiaries will face potential income reductions due to various legal mechanisms targeting their Social Security payments.

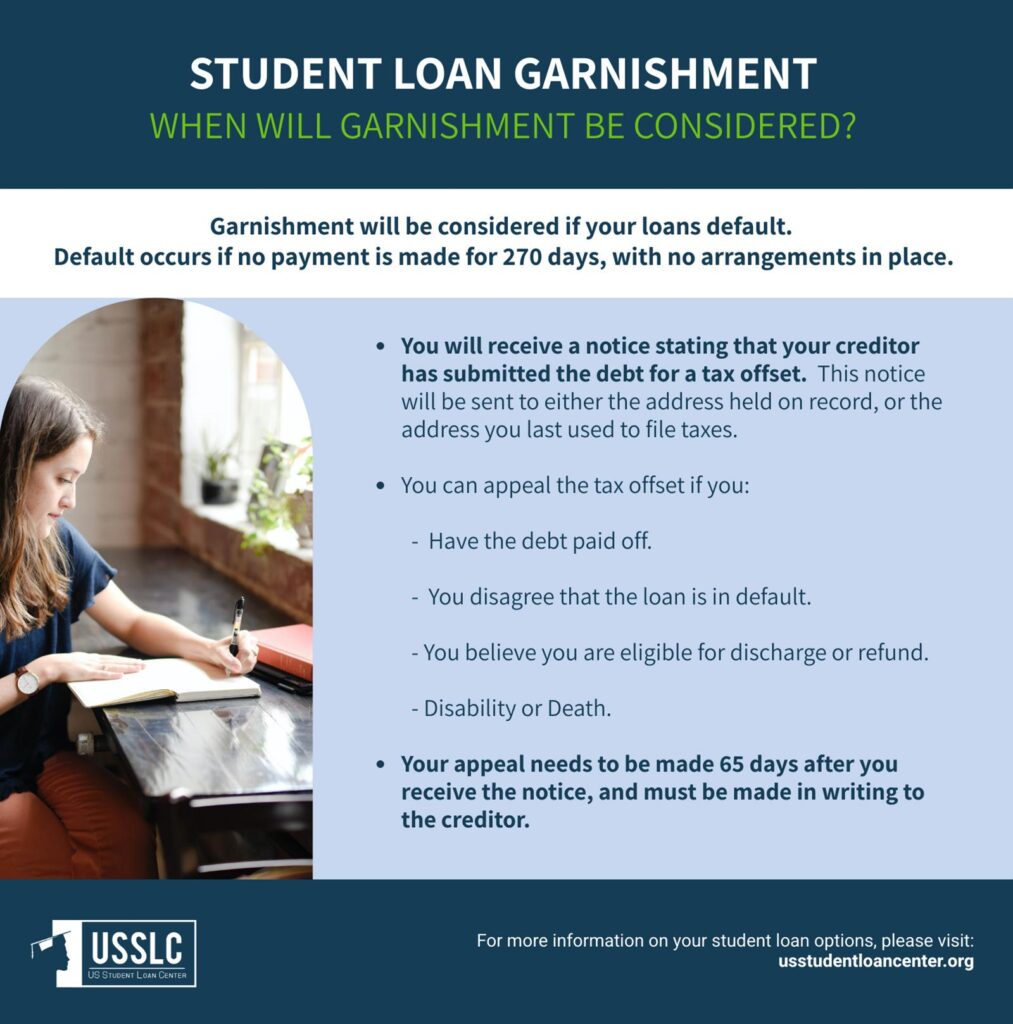

Creditors can legally intercept portions of Social Security income through specific court-authorized processes, including unpaid student loans, tax debts, child support obligations, and certain civil judgments. These garnishments can drastically reduce monthly income, leaving recipients struggling to cover basic living expenses.Understanding legal protections becomes crucial for beneficiaries seeking to shield their funds. Federal law provides certain exemptions that can prevent complete financial devastation. Some income sources remain technically protected,including Supplemental Security Income (SSI) and veterans’ benefits,which generally cannot be garnished without exceptional circumstances.

Strategic financial planning can help individuals minimize potential garnishment risks.Consulting with legal professionals specializing in benefits protection offers personalized guidance tailored to individual circumstances.Some effective strategies include establishing separate bank accounts, documenting income sources, and proactively negotiating with potential creditors.

Beneficiaries with outstanding debts should prioritize communication with collection agencies. Negotiating payment plans or settlement agreements can potentially prevent aggressive garnishment actions. Many creditors prefer structured repayment arrangements over complete income seizure.Technology now provides additional tools for tracking and protecting benefits.Digital financial management platforms can help individuals monitor potential garnishment threats and receive early warning signals. These technological solutions enable proactive defense strategies against unexpected income reductions.

Consumer protection agencies recommend maintaining meticulous financial records and understanding individual rights. Beneficiaries should carefully review all correspondence from creditors and government entities, responding promptly to any garnishment notifications.

Legal resources exist for those facing potential income interruption. Non-profit organizations and government-sponsored legal aid programs offer free consultations and guidance for individuals navigating complex garnishment scenarios.These support networks can provide critical insights into protecting essential income streams.

Preventative measures remain the most effective approach. Establishing emergency funds, maintaining transparent financial records, and seeking professional advice can considerably reduce garnishment risks. Beneficiaries must remain vigilant and proactive in managing their financial landscapes.

The upcoming garnishment period represents a critical moment for millions of Americans relying on Social Security benefits. By understanding legal protections, leveraging available resources, and implementing strategic financial planning, individuals can effectively shield their income and maintain financial stability.