In the ever-evolving landscape of real estate,one homeowner’s bold declaration is challenging the long-standing conventions of property sales. Standing at the crossroads of frustration and innovation,this home seller has drawn a line in the sand,questioning the traditional methods that have long dictated the buying and selling of residential properties. With a pointed critique that resonates with many frustrated property owners, the statement cuts through the noise of standard real estate practices, highlighting the potential for a more efficient, cost-effective approach to home selling. This is a story of one individual’s resistance against a system that seemingly values commissions over convenience, and efficiency over fairness.In the cutthroat world of real estate, traditional selling methods are quickly becoming relics of a bygone era.Homeowners are increasingly questioning the astronomical fees associated with conventional property transactions, sparking a revolution in how properties change hands.

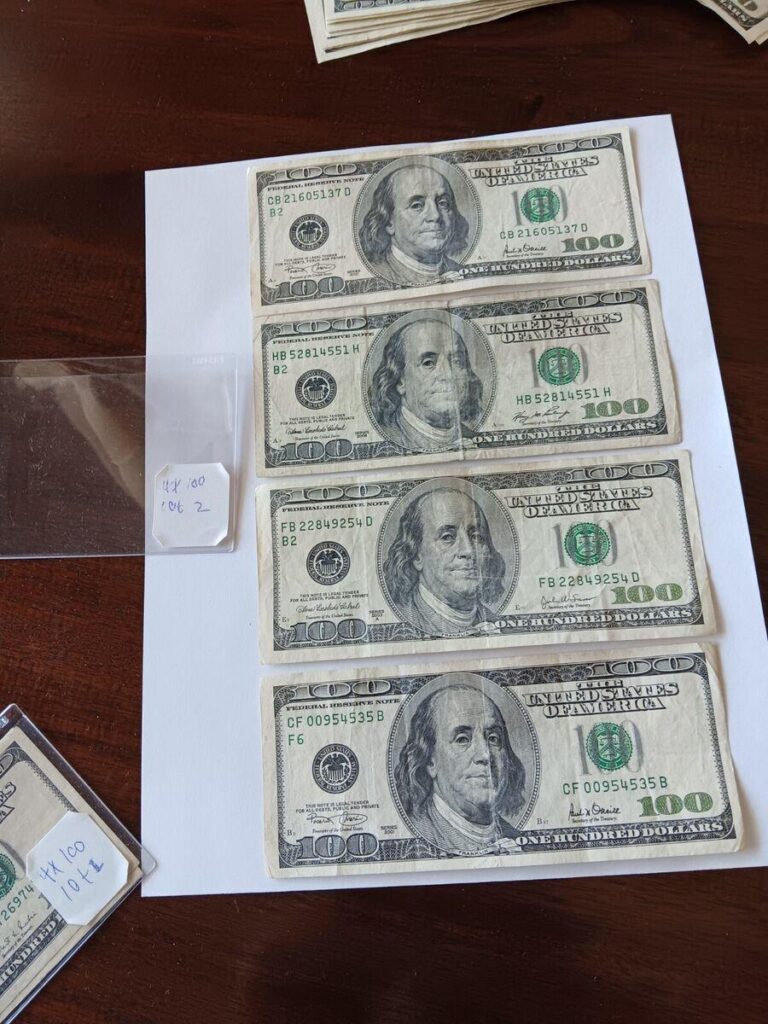

The standard real estate model has long been a cash cow for agents,with commissions frequently enough eating up considerable portions of a home’s sale price. A typical 6% commission on a $500,000 home translates to a staggering $30,000 paid out for what many consider minimal effort. This reality is pushing savvy sellers to explore choice routes that preserve more of their hard-earned equity.

Digital platforms and direct selling strategies are emerging as game-changers in the real estate landscape. Innovative sellers are leveraging technology to bypass traditional intermediaries, using online marketplaces, social media, and targeted marketing to connect directly with potential buyers. These methods can dramatically reduce transaction costs and put more money back into sellers’ pockets.

The economics are stark. A four-hour investment of time and effort can now perhaps save tens of thousands of dollars. Sophisticated homeowners are recognizing that the value provided by traditional real estate agents doesn’t always justify their hefty fees. With robust online tools, professional photography, and strategic pricing, individual sellers can effectively market their properties without surrendering massive chunks of their home’s value.

Technological advancements have democratized the selling process. Virtual tours, complete listing platforms, and data-driven pricing algorithms have leveled the playing field. Homeowners can now access professional-grade resources that were once exclusively available to real estate agencies.

The shift isn’t just about saving money—it’s about reclaiming control. Sellers are no longer passive participants in a transaction controlled by agents. They’re actively managing their most significant asset, making informed decisions, and challenging longstanding industry norms.

Legal protections, online resources, and increasingly user-friendly platforms are making independent selling more accessible than ever.From comprehensive legal document templates to virtual staging tools, sellers have unprecedented support in navigating complex property transactions.

This isn’t about eliminating professional expertise but reimagining how that expertise is delivered and compensated. The real estate industry is being forced to evolve, with more transparent, flexible, and cost-effective models emerging to meet changing consumer demands.

For homeowners watching thousands of dollars evaporate in traditional commissions, the message is clear: there are smarter, more economical ways to sell a property in today’s digital age.