As taxpayers brace for potential shifts in the fiscal landscape, a recent presidential directive has sparked curiosity and speculation about the future of tax filing. President Trump’s order to the Internal Revenue Service (IRS) signals a potential conversion in how Americans will approach their annual financial obligation. With the stroke of an executive pen, the complexity of tax season might potentially be about to undergo a significant metamorphosis, leaving citizens and financial experts alike wondering: What changes are on the horizon, and how will they impact the delicate dance between taxpayers and the government’s revenue collection apparatus? In a move that could reshape the landscape of tax filing for millions of Americans, the recent executive directive from the former president signals potential transformative changes to the Internal Revenue Service’s operational protocols. The unprecedented order targets core administrative functions, possibly altering how taxpayers interact with the federal tax collection system.

Whispers from Capitol Hill suggest the directive aims to streamline tax collection processes while introducing mechanisms that could simplify or complicate tax submission procedures. Sources close to the administration hint at a complete review of current IRS workflows,with implications that extend far beyond traditional bureaucratic reshuffling.

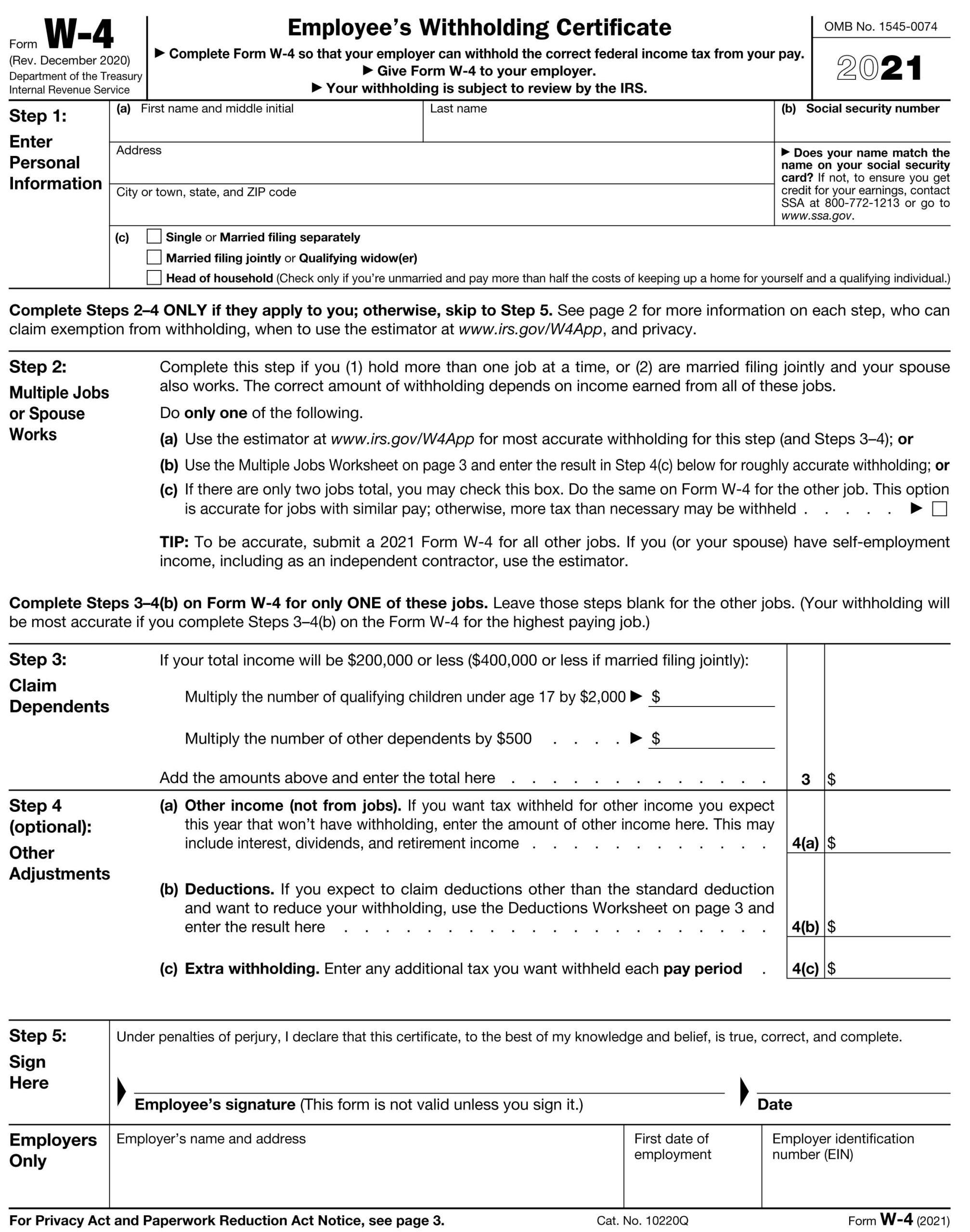

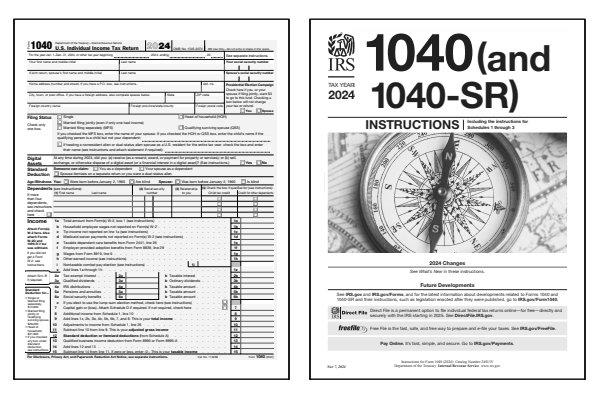

Financial experts are closely monitoring the potential ripple effects. The proposed changes might introduce new digital platforms, modify existing reporting requirements, or implement technology-driven solutions that could fundamentally redesign tax documentation methods.Small business owners and individual taxpayers alike are watching with a mixture of anticipation and apprehension.

One potential outcome involves enhanced digital infrastructure that could reduce processing times and minimize human error in tax submissions. The order potentially mandates significant technological upgrades within the IRS, potentially leveraging artificial intelligence and advanced data analytics to improve efficiency and accuracy.

Critics argue the directive might create additional complexity, while supporters suggest it represents a necessary modernization of an antiquated system. The nuanced approach seems designed to balance technological innovation with practical implementation considerations.

Legal experts are already dissecting the potential constitutional and procedural implications of the executive order. The complex regulatory landscape means any significant changes will likely face intense scrutiny and potential legal challenges from various stakeholders.Economic analysts predict the modifications could have significant implications for tax revenue collection strategies. The proposed changes might introduce more refined tracking mechanisms, potentially closing existing loopholes and creating more obvious reporting frameworks.

Technology sector insiders speculate about the potential integration of blockchain and advanced encryption technologies into tax submission processes. These innovations could revolutionize how financial information is processed, stored, and verified.

The timing of implementation remains uncertain,with government bureaucracies notorious for slow adaptation. Though,preliminary indications suggest a phased approach that would allow gradual integration of new systems and protocols.

Taxpayers are advised to stay informed and prepare for potential shifts in filing requirements. The coming months will likely reveal more details about the scope and specific mechanisms of these proposed changes, which could fundamentally alter the annual ritual of tax submission.