In the high-stakes arena of tech investments, Nvidia has become a silicon siren, captivating investors with its AI-powered performance and market-shaking potential. As the semiconductor giant rides the waves of artificial intelligence innovation, traders and market watchers find themselves at a critical crossroads: Should they dive deeper into NVDA, cash out their chips, or maintain a strategic holding pattern? This analysis peels back the layers of Nvidia’s recent momentum, offering a nuanced perspective on the stock’s current trajectory and future prospects in an increasingly complex technological landscape.In the fast-paced world of technology stocks, Nvidia has once again captured investors’ attention with its remarkable performance. The semiconductor giant’s recent surge has reignited conversations about its investment potential, leaving traders and analysts buzzing with anticipation.

Recent market movements suggest a compelling narrative for Nvidia’s stock trajectory. The company’s dominance in artificial intelligence and graphics processing technologies continues to drive important investor interest. With groundbreaking developments in AI chips and data center solutions, Nvidia has positioned itself as a critical player in the technological ecosystem.

Financial analysts are presenting mixed signals about the stock’s future. Some point to the notable revenue growth and expanding market share as strong indicators of potential upside. The company’s strategic investments in machine learning, autonomous vehicles, and cloud computing have created multiple revenue streams that differentiate Nvidia from customary semiconductor manufacturers.

Market technicals reveal an interesting landscape. The stock has demonstrated resilience despite broader market volatility, with consistent recovery patterns that suggest underlying strength. Institutional investors have been gradually increasing their positions, signaling confidence in the company’s long-term prospects.

However, potential risks cannot be overlooked. Global semiconductor supply chain challenges, geopolitical tensions, and potential regulatory constraints could impact future performance.The intense competition in the AI and graphics processing segments also presents ongoing challenges for sustained growth.

Valuation metrics indicate that Nvidia trades at a premium compared to ancient benchmarks. This suggests investors are pricing in significant future growth expectations. The price-to-earnings ratio and forward-looking projections reflect a market that believes in the company’s transformative potential.

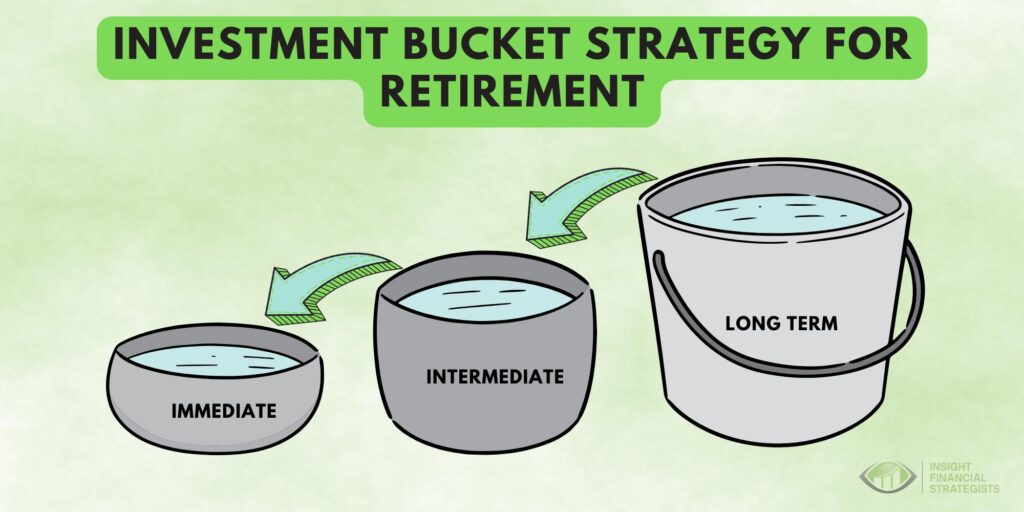

For individual investors, the decision becomes nuanced. Conservative investors might consider a measured approach, possibly implementing dollar-cost averaging strategies. More aggressive traders could see current price levels as an attractive entry point,particularly given the company’s technological leadership.

Options strategies provide additional adaptability for those seeking to manage risk. Covered calls, protective puts, and spread techniques could offer balanced exposure to Nvidia’s potential market movements.The broader technological landscape continues to evolve rapidly, with AI and machine learning presenting unprecedented opportunities. Nvidia’s strategic positioning in these emerging sectors suggests a promising outlook.Critical factors like research and development investments, strategic partnerships, and ability to innovate will ultimately determine long-term performance.

Investors should conduct comprehensive research, evaluate personal risk tolerance, and consider professional financial advice before making investment decisions. The dynamic nature of technology stocks demands continuous monitoring and adaptive strategies.