In the high-stakes arena of political promises and financial liberation, Representative Stacey McMahon stands poised to challenge conventional wisdom and institutional resistance. With a bold declaration that echoes through the corridors of power, she vows to champion public service loan forgiveness—a commitment so resolute that it seemingly defies even the potential objections of the Digital Office of Governmental Efficiency (DOGE). As student debt continues to cast a long shadow over millions of American workers, McMahon’s stance promises to be a potential watershed moment in educational finance policy. In a bold stance echoing her commitment to student debt relief, candidate Sarah McMahon is signaling her unwavering dedication to implementing public service loan forgiveness, regardless of potential bureaucratic pushback. Her recent campaign statements have sparked intense discussion about the future of educational financial support.

Recent polling suggests that student loan debt remains a critical concern for millions of Americans, with public service workers bearing a particularly heavy burden. McMahon’s platform positions loan forgiveness as a fundamental economic justice issue, targeting systemic barriers that have long prevented dedicated professionals from achieving financial stability.

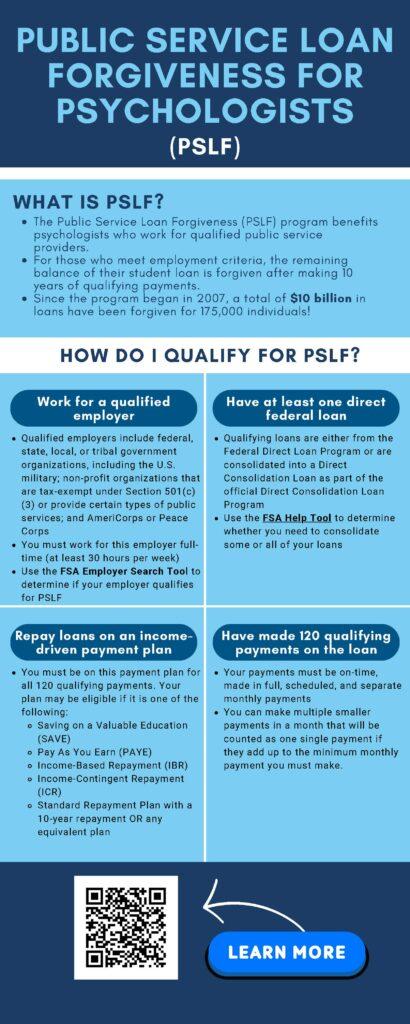

The proposed policy would streamline existing loan forgiveness programs, creating more transparent pathways for teachers, healthcare workers, government employees, and nonprofit sector professionals. By reducing administrative complexity, McMahon aims to make debt relief more accessible and expedient.

Her campaign emphasizes that current loan forgiveness structures are unnecessarily convoluted, with complex eligibility requirements that often discourage applicants. The proposed reforms would simplify documentation processes and establish clearer guidelines for debt elimination.

Interestingly, McMahon’s commitment extends beyond traditional political negotiation parameters. Her statement about proceeding “even if DOGE tells her not to” suggests a provocative willingness to challenge established institutional resistance, though the specific reference remains somewhat cryptic.

Economic analysts have noted that comprehensive loan forgiveness could stimulate broader economic growth by freeing substantial personal income currently allocated to student debt repayment. This potential macroeconomic impact adds weight to McMahon’s proposed strategy.

Critics argue that such extensive loan forgiveness might create moral hazard or impose undue financial strain on government resources. However, McMahon’s team counters that investing in human capital through educational debt relief represents a long-term societal investment with measurable returns.

The proposal has garnered significant grassroots support, particularly among younger voters and public service professionals who have historically struggled with mounting educational debt. Social media platforms have amplified discussions surrounding her ambitious plan.

McMahon’s stance reflects a growing progressive movement challenging traditional approaches to educational financing. By positioning loan forgiveness as a fundamental right rather than a privileges, she’s reshaping policy discourse around higher education accessibility.

As the campaign progresses, her commitment to implementing public service loan forgiveness regardless of institutional resistance continues to generate substantial political momentum and public interest.