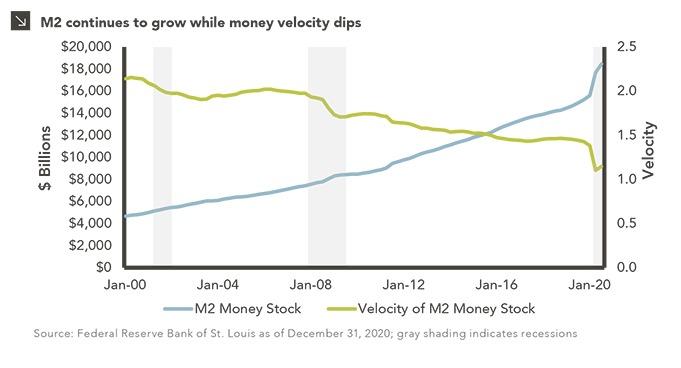

In the intricate dance of economic indicators, a subtle yet perhaps seismic shift is brewing beneath the surface of America’s financial landscape. The money supply – that invisible river of currency flowing through the nation’s economic veins – is beginning to pulse with an increasing rhythm, sending whispers of potential change to those who know how to listen. As the digits grow and the graphs curve upward, investors and market watchers are leaning in, sensing that this seemingly mundane metric might be the harbinger of a significant market metamorphosis. What secrets does this accelerating monetary expansion hold? What tremors might it trigger in the vast, interconnected ecosystem of stocks, investments, and economic expectations? The answer could be closer than we think, waiting to unfold its narrative of potential change. Recent economic indicators suggest a potentially transformative shift in financial markets, with key signals emerging from the velocity of money circulation. The M2 money supply, a critical measure of liquid cash and easily convertible assets in the economy, has been showing intriguing patterns that could portend significant stock market movements.

Financial analysts are closely monitoring these monetary dynamics, noting that accelerated money supply growth often precedes substantial market recalibrations. The intricate dance between liquidity, investor sentiment, and market valuations creates a complex ecosystem where subtle changes can trigger cascading effects.

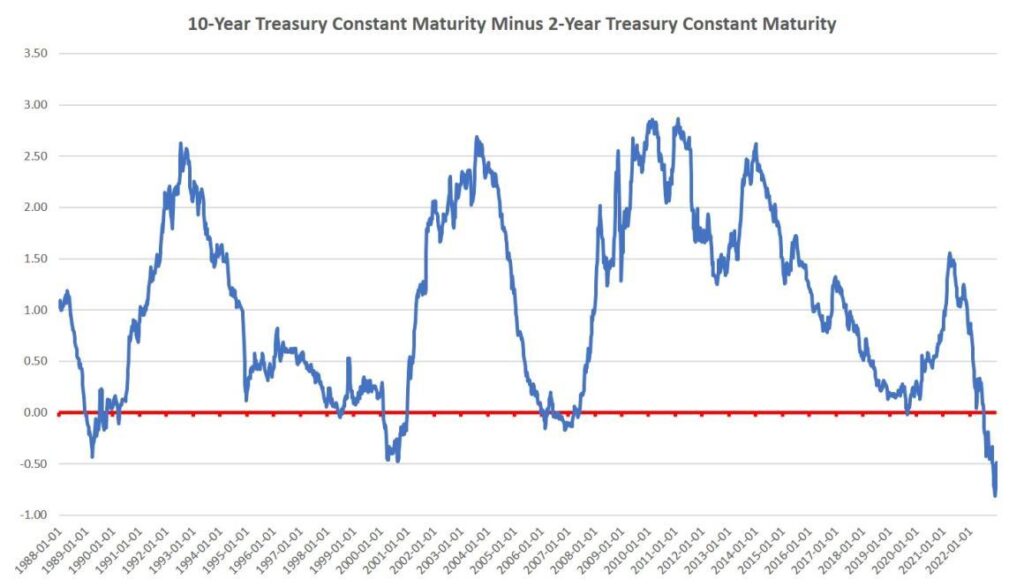

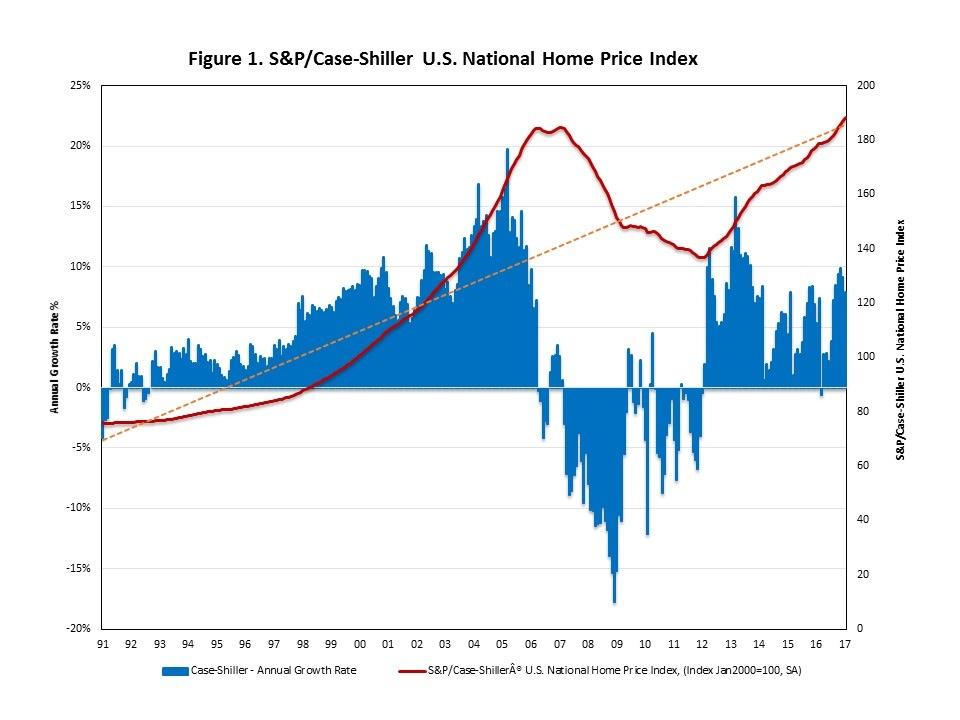

Historical data reveals that periods of rapid money supply expansion frequently coincide with heightened market volatility.Investors and economists are parsing through these indicators,searching for predictive insights that might illuminate potential investment strategies.The Federal Reserve’s monetary policies play a crucial role in these fluctuations. Their delicate balancing act of managing inflation, stimulating economic growth, and maintaining market stability becomes increasingly challenging in environments characterized by rapid monetary expansion.Emerging trends suggest that the current monetary landscape might be setting the stage for significant market repositioning. Institutional investors are recalibrating portfolios, anticipating potential shifts in asset valuations and investment opportunities.Technological advancements and global economic interconnectedness have further complicated traditional monetary models. The rapid evolution of financial instruments and digital currencies adds layers of complexity to understanding money supply dynamics.

Risk-tolerant investors might view these monetary signals as potential opportunities for strategic repositioning.Conversely, conservative investors may interpret the same data as a call for cautious asset allocation and diversification.

Economic indicators consistently demonstrate that money supply growth is not a standalone metric but part of a sophisticated, interconnected financial ecosystem. Sophisticated investors recognize the nuanced relationships between monetary expansion, market sentiment, and potential investment returns.

The current trajectory suggests a period of potential transformation,where traditional investment paradigms might be challenged. Adaptive strategies that can quickly respond to evolving monetary conditions will likely prove most resilient.

Macroeconomic factors, including global trade dynamics, geopolitical tensions, and technological disruptions, further influence these monetary trends. The interplay of these complex variables creates a dynamic habitat where predictive models must continuously evolve.

As financial markets navigate these intricate currents, staying informed and maintaining a flexible investment approach becomes paramount. The ongoing metamorphosis of monetary systems demands vigilant observation and strategic thinking.