In the ever-shifting landscape of real estate, a new phenomenon is reshaping the market’s narrative: a dramatic spike in canceled home sales. As the dust settles on months of economic uncertainty, prospective buyers and sellers are increasingly choosing to step back from the table, their patience worn thin by volatile pricing, rising interest rates, and a complex transactional environment. This mass exodus from pending deals reveals more than just market friction—it signals a profound recalibration of expectations in an industry that has long been considered a cornerstone of the American dream. In the tumultuous landscape of real estate, a brewing storm of frustration is reshaping the housing market. Transactions once considered solid are now crumbling under the weight of economic uncertainty and shifting expectations. Buyers and sellers are increasingly hitting the eject button, walking away from deals that no longer align with their financial strategies.

The phenomenon isn’t just a blip—it’s a critically important trend gaining momentum across multiple metropolitan areas. Steep mortgage rates, unpredictable property valuations, and a general sense of market volatility are driving potential homeowners to reconsider their commitments. What was once a straightforward path to homeownership now feels like navigating a complex maze with constantly changing walls.

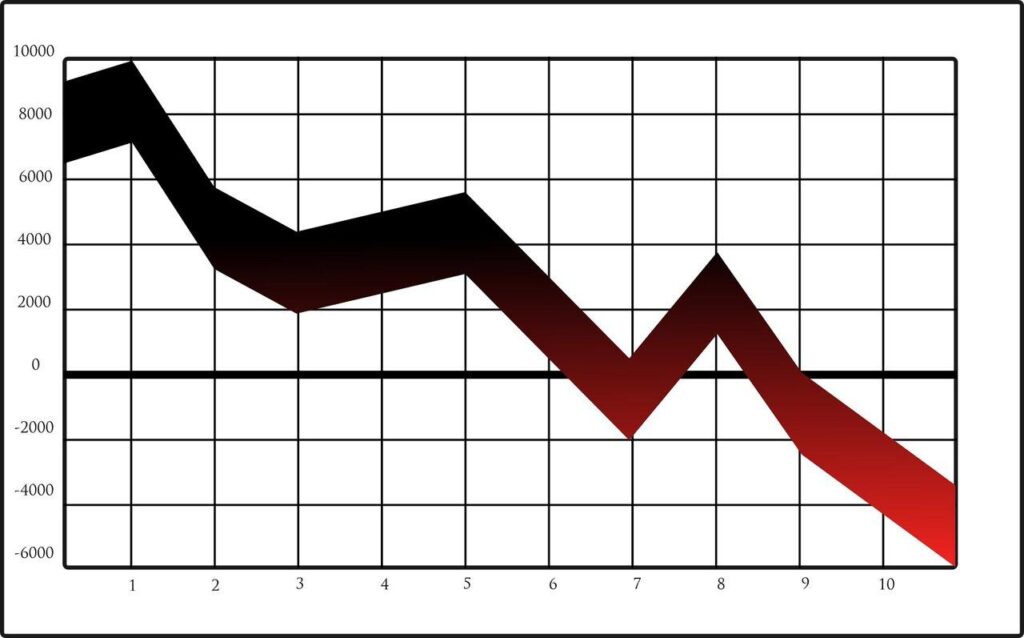

Data reveals a stark picture of mounting cancellations. Some regions are experiencing a dramatic spike in terminated contracts, with some markets seeing up to 15-20% of pending sales falling through.This represents a substantial shift from previous years when real estate transactions were more predictable and smooth.

Economic pressures play a critical role in this emerging trend. Buyers facing higher borrowing costs find themselves reassessing financial feasibility. Sellers, simultaneously confronting challenging market conditions, are more willing to withdraw listings rather than accept reduced prices or unfavorable terms.

The ripple effects extend beyond individual transactions. Real estate professionals, mortgage lenders, and related industries are feeling the impact of increased uncertainty.Agents who once relied on consistent commission structures now navigate a more unpredictable landscape, adapting their strategies to accommodate rapid market shifts.

Interestingly,the cancellation trend isn’t uniform across all market segments. Luxury properties and specific geographic regions experience different patterns, reflecting localized economic dynamics. Urban centers and suburban markets demonstrate varying levels of transaction volatility.

Psychological factors also contribute to this phenomenon. The pandemic-induced reimagining of work and living spaces, combined with economic instability, has prompted many to pause or cancel real estate plans. What seemed like a reasonable investment a year ago might now appear risky or impractical.

Technology and data transparency are enabling more informed decision-making. Potential buyers and sellers have unprecedented access to market facts,empowering them to make strategic choices about entering or exiting real estate transactions.As the market continues to evolve, flexibility becomes paramount. Those navigating real estate transactions must remain agile, understanding that today’s opportunities might transform dramatically in the coming months. The current landscape demands careful analysis, strategic thinking, and a willingness to adapt to rapidly changing conditions.

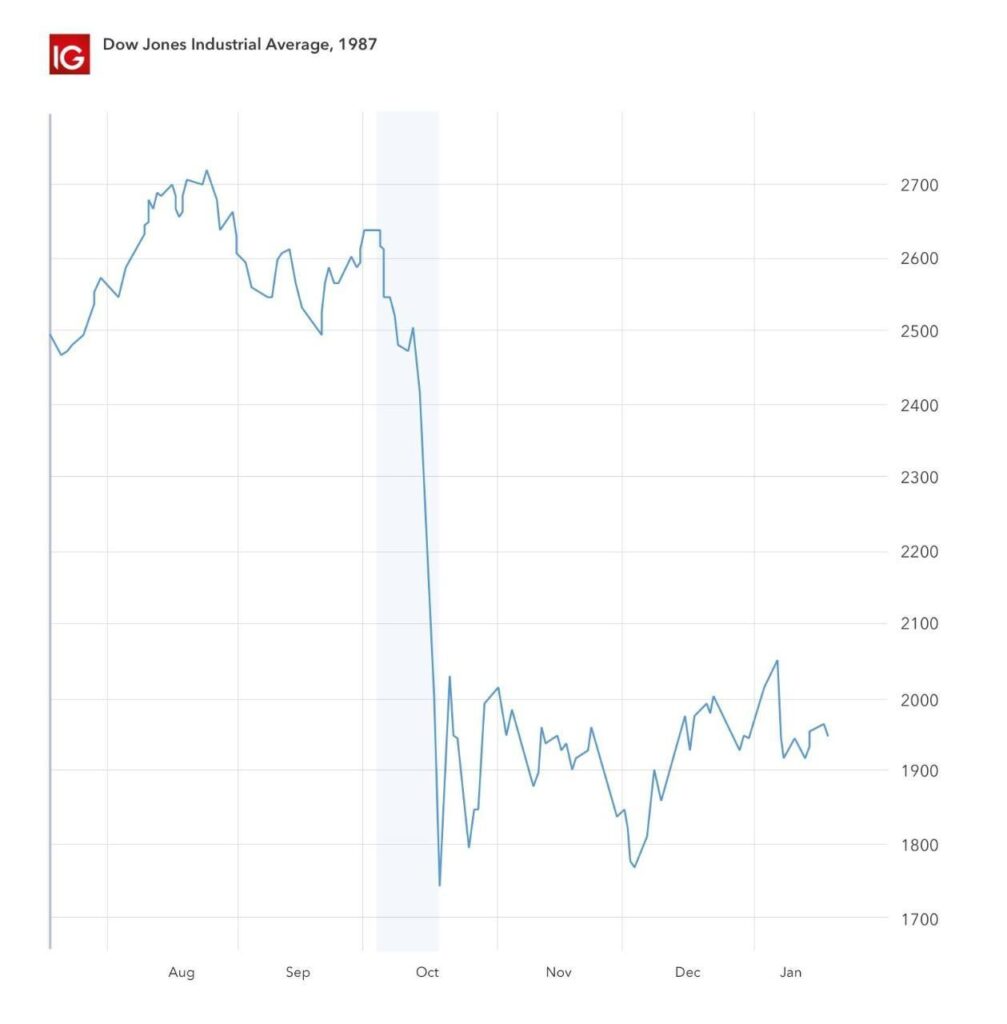

Buffett: This year’s stock market turmoil ‘is really nothing’