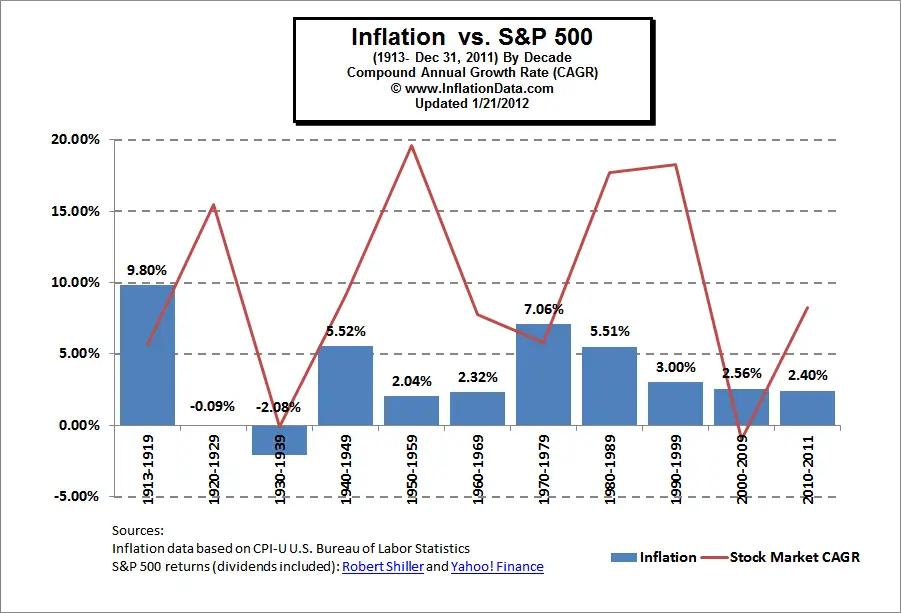

In the economic ballet of numbers and percentages, May’s financial stage saw inflation pirouetting to a more pronounced rhythm. As the Federal Reserve’s preferred inflation indicator took center stage, it revealed a performance of rising prices that caught the market’s attentive gaze. This delicate dance of economic indicators weaves a narrative of ongoing monetary dynamics, where each percentage point tells a story of consumer spending, market pressures, and the intricate choreography of financial trends. The latest economic data reveals a nuanced picture of price dynamics, signaling potential challenges for policymakers and consumers alike. Recent figures from the Personal Consumption Expenditures (PCE) index suggest an uptick in inflationary pressures during May, prompting closer scrutiny of economic indicators.

Economists and market analysts are parsing through the numbers, finding a subtle but meaningful acceleration in price increases across various sectors.The core PCE price index, which excludes volatile food and energy components, demonstrated a more pronounced rise than previous months, catching the attention of financial experts.

Drilling into the specifics, the data shows a complex interplay of market forces.Goods and services categories exhibited different trajectories,with some segments experiencing more important price pressures than others. Consumer discretionary spending and essential services showed distinct inflationary patterns, reflecting the ongoing economic recalibration post-pandemic.

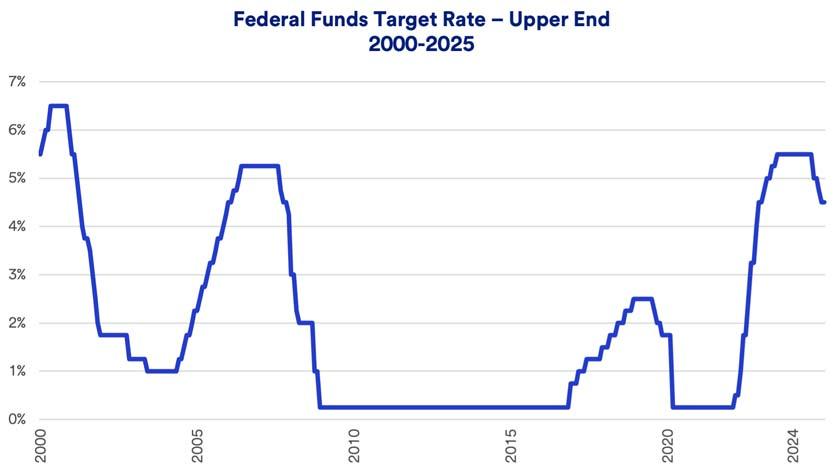

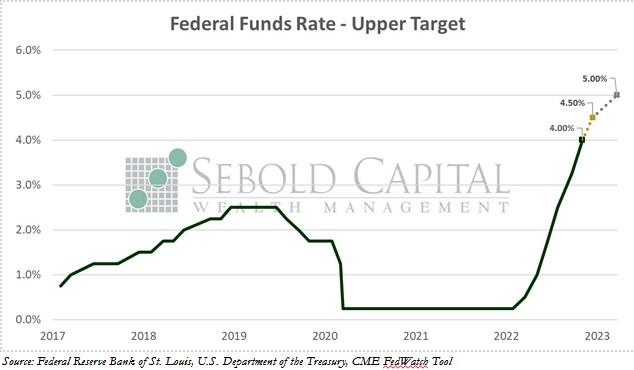

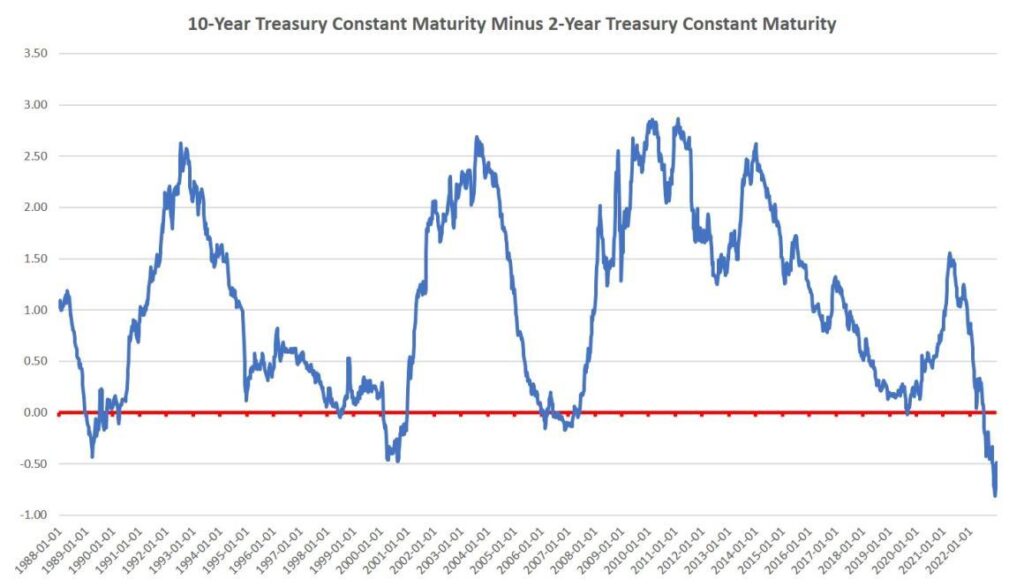

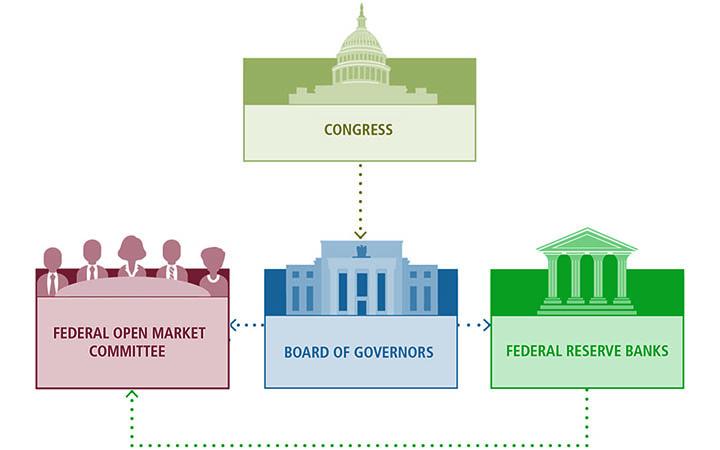

The Federal Reserve will likely interpret these figures with careful consideration, weighing the implications for monetary policy. While the increase wasn’t dramatically steep, it represents a meaningful signal about underlying economic conditions. The central bank’s delicate balancing act between controlling inflation and supporting economic growth remains at the forefront of economic discussion.

Sector-specific analysis reveals fascinating nuances. Healthcare, housing, and transportation demonstrated varied price movement patterns, indicating the multifaceted nature of contemporary inflation dynamics. Some industries showed more resilience, while others experienced more pronounced cost pressures.

Consumer sentiment might be influenced by these developments,perhaps impacting spending behaviors and economic expectations. The psychological aspect of inflation perception plays a crucial role in broader economic mechanisms, beyond pure numerical indicators.

Geopolitical factors and global supply chain complexities continue to contribute to pricing challenges. International trade dynamics, energy market fluctuations, and ongoing economic recovery efforts worldwide inject additional complexity into inflation calculations.

Financial markets responded with measured reactions, suggesting a degree of anticipation and preparedness for such inflationary signals. Investors and economists remain cautiously attentive, recognizing the potential long-term implications of these price trends.

The comprehensive view suggests a nuanced economic landscape where multiple factors intersect. While the inflation increase isn’t cause for immediate alarm, it represents an significant data point in understanding broader economic trajectories.

Policymakers, business leaders, and economists will continue to monitor these developments closely, seeking to understand the underlying mechanisms driving price movements and their potential future implications.

Trump: ‘I have a Fed person who is not really doing a good job’