In the ever-shifting landscape of home financing, today’s mortgage market is painting a picture of cautious optimism. As July 22, 2025 unfolds, borrowers and homeowners are witnessing a subtle yet significant descent in interest rates, offering a glimmer of hope for those navigating the complex terrain of home loans and refinancing. Like a gentle breeze softening the economic horizon, these downward trends are catching the attention of potential buyers and existing homeowners alike, signaling a potential moment of possibility in the real estate financial ecosystem. In the ever-evolving landscape of real estate financing, today’s market presents a promising scenario for potential homeowners and those looking to refinance their existing mortgages. The downward trajectory of interest rates is creating a ripple of excitement across the housing sector, offering a glimmer of hope for borrowers seeking more favorable lending conditions.

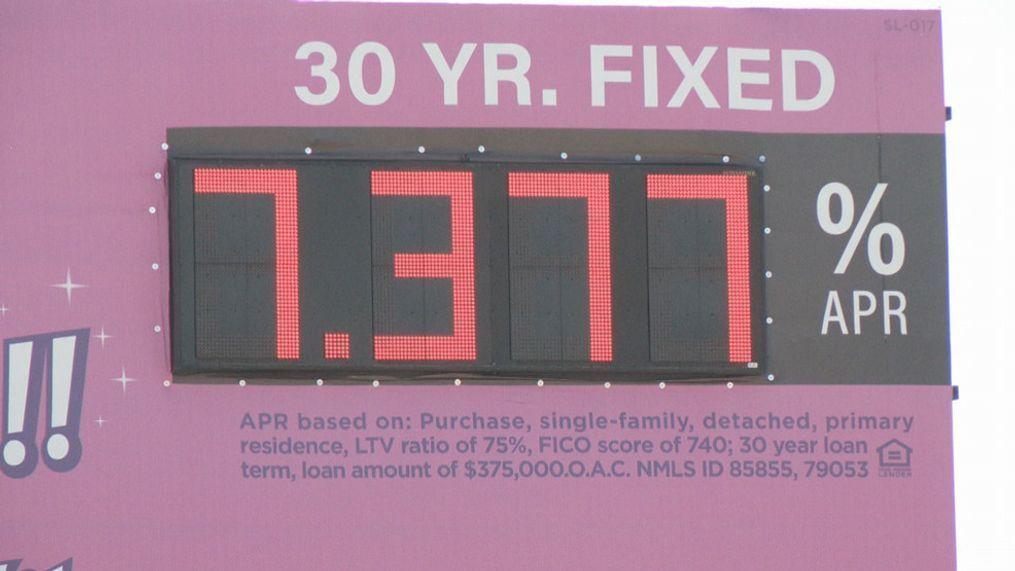

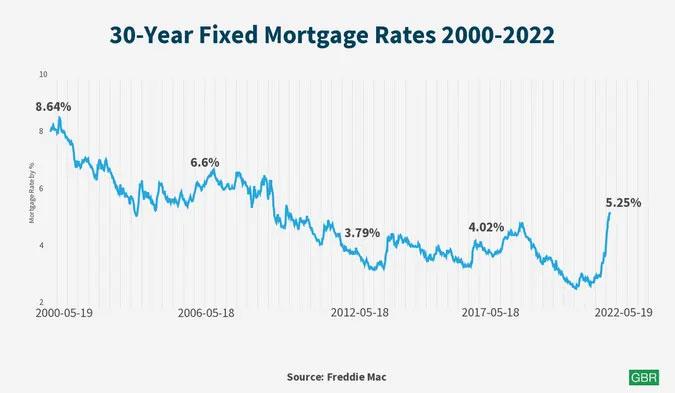

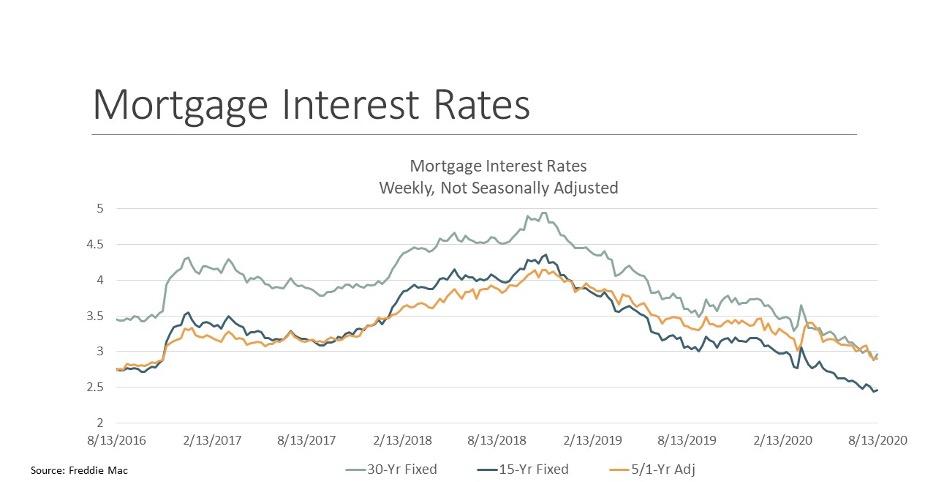

Recent data from financial analysts indicates a nuanced shift in the mortgage marketplace. The 30-year fixed-rate mortgage has experienced a notable decline, dropping by several basis points compared to recent weeks. This subtle yet significant movement represents a potential turning point for those contemplating home purchases or restructuring their current loan arrangements.

Conventional loan products are showing the most pronounced changes,with rates sliding to levels that haven’t been seen in recent months. Lenders are responding to broader economic indicators, including Federal Reserve policy adjustments and overall market sentiment. The result is a more attractive borrowing environment that could provide ample long-term savings for strategic homeowners.

Refinancing opportunities are particularly compelling in the current market. Homeowners with existing mortgages originated during higher-rate periods now have a window to perhaps reduce their monthly payments and overall interest exposure. Financial experts recommend careful analysis of individual circumstances, as the break-even point for refinancing varies depending on specific loan terms and personal financial goals.Government-backed loans, including FHA and VA options, are also reflecting the broader market trends. These specialized loan products are showing increased flexibility, with some lenders offering more competitive rates to attract qualified borrowers. The interplay between conventional and government-backed lending continues to create a dynamic mortgage landscape.Prospective buyers should remain cautious yet optimistic. While the current rate environment appears favorable, individual qualification remains crucial. Credit scores, debt-to-income ratios, and overall financial health continue to play pivotal roles in securing the most attractive loan terms.

Regional variations continue to impact mortgage rates, with certain geographic markets experiencing more pronounced rate fluctuations than others. Urban centers and emerging housing markets are showing particular sensitivity to these changes, presenting unique opportunities for savvy borrowers.

Economic forecasters suggest the current trend may represent more than a temporary dip. Underlying economic factors, including inflation expectations and monetary policy, indicate a potentially sustained period of more favorable borrowing conditions. However, the mortgage market remains inherently dynamic, with rates subject to rapid shifts based on complex economic indicators.