America’s financial future hangs in a delicate balance, with retirement savings telling a story of hope, challenge, and stark economic realities. Beyond mere numbers, these nest eggs represent years of labour, dreams, and strategic financial planning—or the lack thereof. As workers across the nation navigate an increasingly complex economic landscape, understanding how retirement accounts stack up by age becomes more than just a statistical exercise—it’s a mirror reflecting individual financial health and national economic trends. From early career millennials to seasoned baby boomers, each age group carries its own unique savings narrative, revealing surprising insights into the American approach to long-term financial security. Retirement savings can feel like a high-stakes financial chess game, with each age group navigating different strategic moves. Recent data reveals intriguing patterns about how Americans are preparing for their golden years.

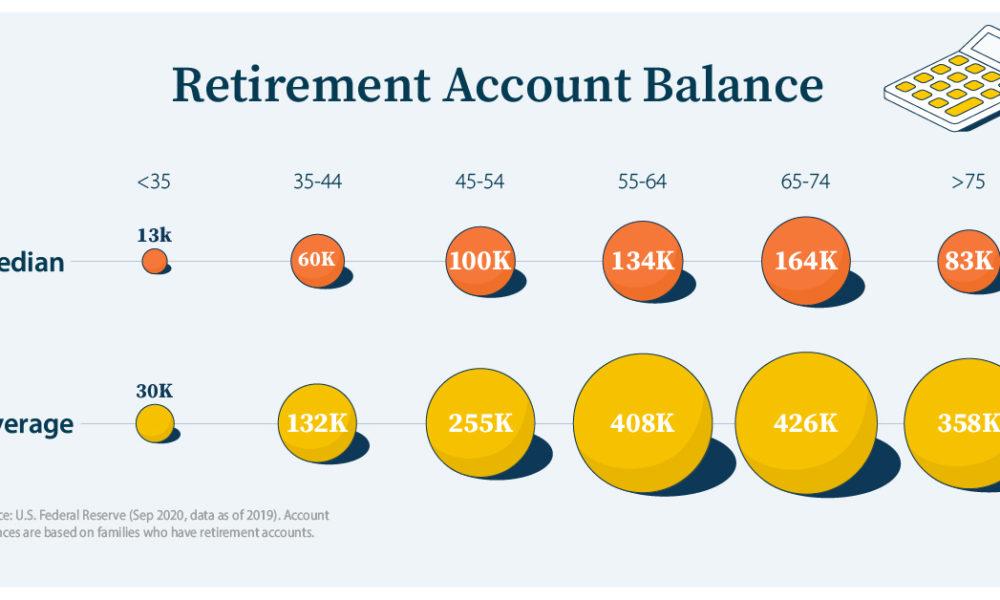

For those in their 20s, the average retirement account balance hovers around $10,500. While this might seem modest, early savers have a notable advantage through compound interest. Millennials are increasingly aware of the importance of starting early, even if their contributions are small.Hitting the 30s,the average retirement savings climbs to approximately $38,400. This decade often coincides with career advancement and potentially higher earning potential. Many individuals begin to take retirement planning more seriously, increasing 401(k) contributions and exploring investment options.

By the 40s,the stakes rise dramatically.The median retirement account balance reaches about $63,000. This period represents a critical financial crossroads where aggressive saving strategies become paramount. Career professionals typically experience peak earning years, enabling more considerable retirement contributions.

Those in their 50s see a substantial jump, with average retirement savings around $117,000.This decade becomes crucial for catch-up contributions and maximizing retirement accounts. Many individuals start making more significant financial decisions, reassessing investment portfolios and retirement timelines.

Approaching retirement in the 60s, the average savings peak at roughly $172,000.While this might sound substantial, financial experts suggest this amount falls short of ensuring comfortable retirement years.Many individuals continue working part-time or explore alternative income streams to supplement their savings.

Generational differences play a significant role in retirement preparedness. Baby Boomers generally have more traditional retirement savings approaches, while younger generations embrace diverse investment strategies, including cryptocurrency and alternative assets.

Factors influencing retirement savings vary widely: income levels, industry sector, geographic location, and individual financial literacy all contribute to potential nest egg size.Economic fluctuations, student loan debt, and healthcare costs further complicate retirement planning.

Experts recommend consistently saving 10-15% of annual income, diversifying investments, and taking advantage of employer-matching 401(k) programs. Individual retirement accounts (IRAs) offer additional tax-advantaged saving opportunities.

Technology and financial apps have transformed retirement planning,providing real-time tracking,personalized recommendations,and easier investment access. Younger generations leverage these tools to make more informed financial decisions.

Understanding retirement savings benchmarks provides valuable viewpoint, but individual financial circumstances remain unique. Regular financial assessments, adaptable strategies, and proactive planning are key to building a robust retirement portfolio.