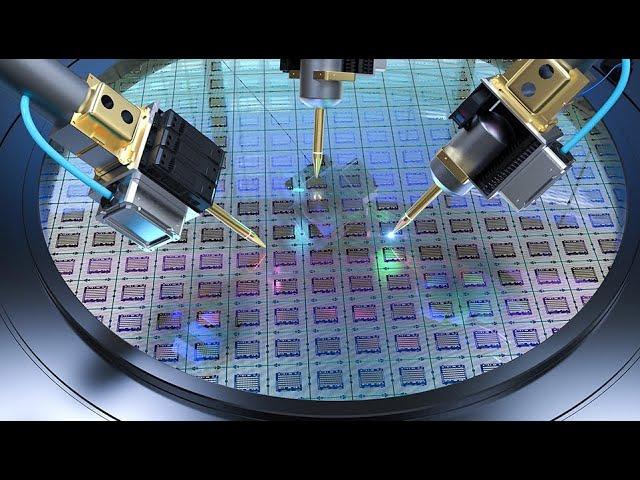

In the high-stakes chess game of global tech manufacturing, Nvidia finds itself navigating a complex labyrinth of geopolitical tensions and production challenges. As the silicon titan attempts to restart its operations in China, recent reports from The Information reveal a landscape fraught with intricate obstacles, where cutting-edge technological ambitions collide with regulatory hurdles and strategic constraints. The semiconductor giant’s journey unfolds like a nuanced narrative of innovation, limitation, and strategic recalibration in one of the world’s most dynamic technological markets. Semiconductor giant Nvidia’s aspiring plans to resume graphics card production in China are encountering notable roadblocks, casting uncertainty over its strategic manufacturing approach in the world’s largest technology market.

Recent reports suggest the company is grappling with complex challenges that extend beyond simple logistical considerations. The intricate web of export restrictions, geopolitical tensions, and supply chain complexities have created a formidable landscape for Nvidia’s re-entry strategy.

Sources familiar with the matter indicate that developing localized production capabilities requires navigating a labyrinth of regulatory requirements. While Nvidia has demonstrated remarkable adaptability in previous technological transitions, the current scenario presents unprecedented hurdles.

The primary impediment stems from stringent U.S. export controls targeting advanced semiconductor technologies. These regulations specifically aim to limit China’s access to cutting-edge computing hardware, effectively constraining Nvidia’s traditional manufacturing methodologies.

Manufacturing partners in China are reportedly struggling to recalibrate production lines to comply with international restrictions while maintaining technological sophistication. The delicate balance between innovation and regulatory compliance demands intricate engineering solutions and strategic reconfiguration.

Technical specifications for potential graphics card iterations must now be meticulously designed to circumvent export limitations. This requires substantial research and progress investment,potentially slowing down Nvidia’s market responsiveness.

Supply chain experts suggest that option manufacturing strategies might emerge, potentially involving localized component sourcing and modified design architectures. However, such approaches demand significant financial and intellectual capital.The economic implications extend beyond Nvidia’s immediate operational challenges.The semiconductor industry watches closely, recognizing that this scenario could establish precedents for future international technology collaborations.

Performance benchmarks and technological capabilities remain critical considerations. Nvidia must ensure that any localized production maintains the high-performance standards that have defined its global reputation.

Financial markets have responded with cautious speculation, reflecting the complexity of Nvidia’s current strategic positioning. Investors are carefully monitoring developments, understanding that the company’s ability to navigate these challenges could significantly impact its long-term growth trajectory.

While substantial obstacles persist, Nvidia’s past track record of technological innovation suggests the company is well-positioned to develop creative solutions.The unfolding scenario represents a critical test of its adaptability in an increasingly fragmented global technology landscape.Collaborative efforts between engineering teams, regulatory experts, and strategic planners will be paramount in determining the success of Nvidia’s China restart initiative. The coming months will likely reveal the depth of the company’s strategic resilience and technological ingenuity.