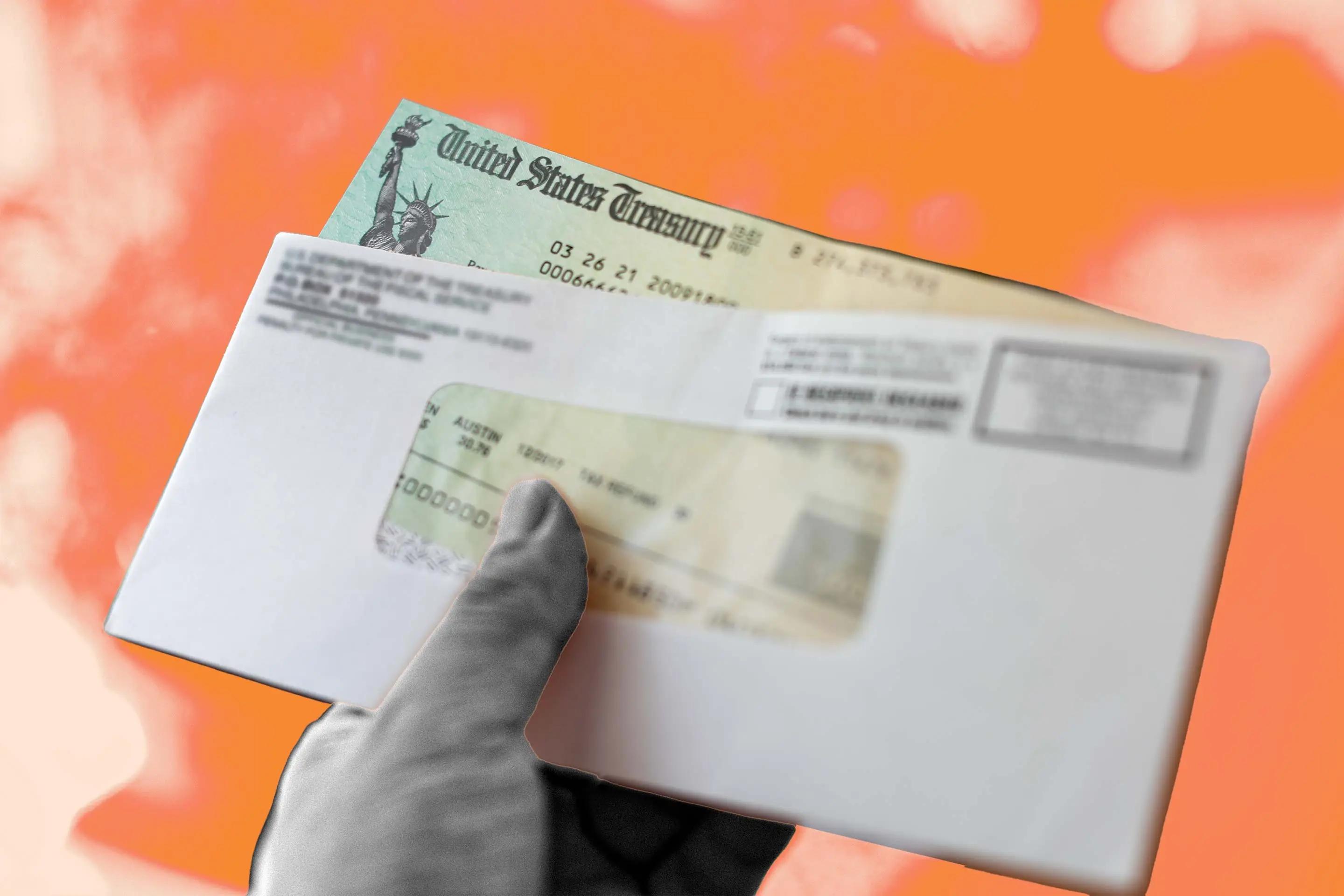

In the ever-evolving landscape of financial relief, the Internal Revenue Service (IRS) is once again stepping into the spotlight, this time with a substantial $2.4 billion stimulus package that could bring welcome respite to qualifying Americans. As economic uncertainties continue to ripple through households, these checks represent more than just monetary support—they’re a lifeline of hope. But the burning question on everyone’s mind: Do you make the cut? Join us as we unravel the eligibility criteria, decode the fine print, and help you determine whether this latest round of government support is headed your way. In a surprising move, the Internal Revenue Service (IRS) is preparing to distribute a substantial sum of $2.4 billion in stimulus payments to eligible individuals across the United States. This latest round of financial support aims to provide relief to specific groups of taxpayers who may have missed out on previous stimulus efforts.

Qualifying for these checks depends on several key criteria. Primarily, taxpayers who filed their 2020 or 2021 tax returns and discovered they were owed additional recovery rebate credits may be among the recipients. Those who experienced significant financial hardships during the pandemic and did not receive full previous stimulus payments could find themselves in line for this unexpected windfall.

The distribution targets various demographic groups, including low-income families, individuals with unique tax circumstances, and those who may have experienced substantial economic challenges. Automatic payments will be processed for those who meet the specific eligibility requirements, with no additional application necessary.

Experts recommend checking your eligibility through the IRS website or consulting with a tax professional. The agency will use direct deposit information from previous tax returns or send paper checks to qualifying individuals. Taxpayers should ensure their current mailing address and banking information are up to date to avoid any potential delays in receiving their payment.

Some key factors that might impact eligibility include income thresholds, dependency status, and specific pandemic-related financial circumstances. Individuals who experienced job loss, reduced income, or other economic disruptions during the past few years may find themselves in a favorable position to receive these stimulus funds.

The timing of these payments comes as many Americans continue to navigate ongoing economic challenges. While the amount may vary depending on individual circumstances, the additional financial support could provide crucial relief for families struggling to make ends meet.

Tax professionals advise recipients to carefully review any incoming communications from the IRS and verify the legitimacy of the payment. Scams related to stimulus checks have been prevalent in previous distribution rounds, so caution is recommended.

For those uncertain about their eligibility, the IRS website offers comprehensive information and resources. Online tools and contact centers can provide detailed guidance about potential qualification and expected payment amounts.

This latest stimulus effort represents another step in the government’s ongoing response to economic challenges brought about by recent global events. As financial landscapes continue to evolve, these targeted financial supports aim to provide meaningful assistance to those most in need.