In the high-stakes world of market maneuvers and presidential proclamations, a curious financial tale emerged from the volatile intersection of social media and trade policy. When Donald Trump took to his preferred platform with a seemingly offhand suggestion about buying, astute investors who decoded the subtext found themselves riding a wave of profitable speculation. This intriguing episode underscores the unique market dynamics that can unfold when a former president’s digital utterances intersect with complex international trade negotiations, revealing a narrative where a few strategic words can translate into tangible financial gains.In the high-stakes world of financial markets, a single social media post from a prominent figure can trigger meaningful investment movements. Former President Donald Trump’s recent communication strategy demonstrated this phenomenon with remarkable clarity, revealing how his digital missives can translate into tangible financial gains for attentive investors.

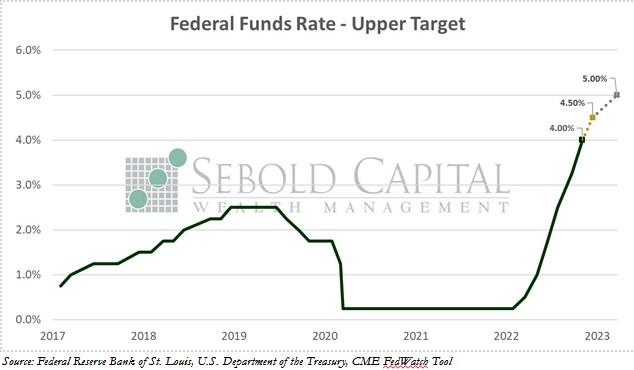

When Trump suggested a potential pause in tariffs against China, savvy market participants who closely monitored his social media channels found themselves positioned for potential profit. The strategic timing and specific language of his post created a ripple effect across various trading platforms, generating immediate market reactions.

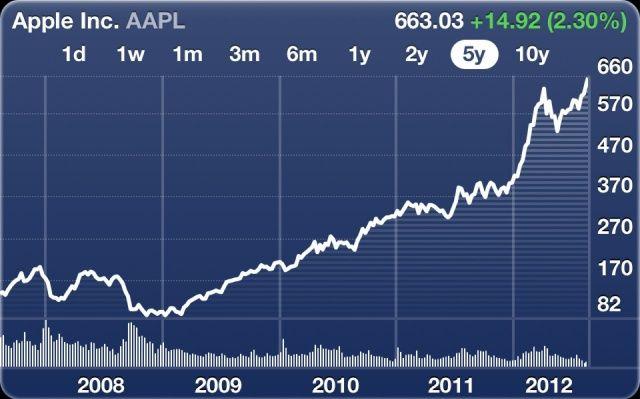

Investors who swiftly interpreted Trump’s message and adjusted their portfolios accordingly experienced notable financial benefits. The speedy response to his communication underscored the growing influence of real-time digital facts in contemporary investment strategies.

Market analysts noted that Trump’s communication style consistently provides unique investment signals. His unfiltered approach to discussing economic policies and international trade relationships offers complex investors an unconventional yet potentially lucrative information stream.

The tariffs pause proposal highlighted a broader trend of how political communication now intersects with financial decision-making. Social media platforms have transformed from mere communication tools to potential market-moving mechanisms, where a few carefully worded statements can shift billions in market capitalization.

Financial experts observed that the most successful investors demonstrated exceptional agility in interpreting Trump’s post. Those who understood the nuanced implications of his message and rapidly executed strategic trades positioned themselves advantageously in volatile market conditions.

The incident also reflected the evolving landscape of information dissemination in financial markets. Traditional research methods now coexist with real-time digital signals,creating a more dynamic and complex investment environment where speed and interpretation are crucial.

Trading algorithms and individual investors alike increasingly recognize the potential value embedded in high-profile social media communications.Trump’s posts have consistently demonstrated the capacity to generate immediate market movements, challenging conventional information distribution channels.

This phenomenon extends beyond a single instance, representing a broader shift in how financial information is consumed and acted upon. The intersection of political communication and investment strategies continues to reshape traditional market dynamics.

For investors willing to navigate this complex landscape,understanding the potential market implications of digital communications has become an essential skill. The ability to quickly analyze and respond to such signals can translate into significant financial opportunities.

Donald Trump Says ‘Market Is Going To Boom,’ Claiming ‘$6-7 Trillion’ Worth Of Inflows Will Come After The Worst Selloff Since 2020