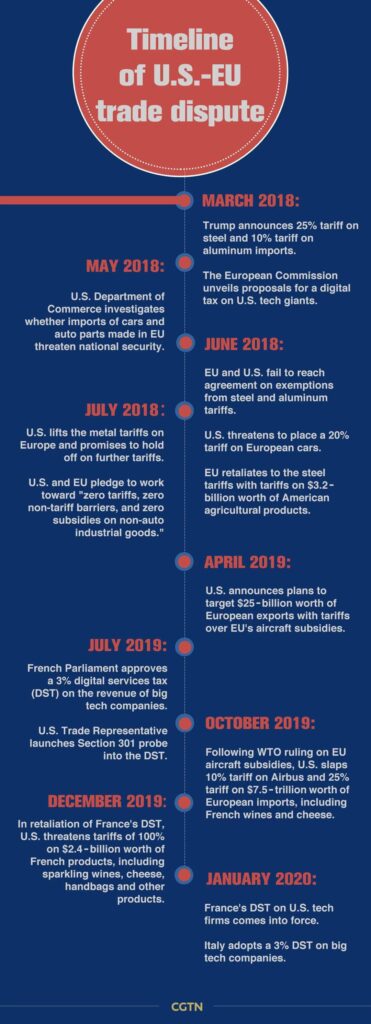

In the high-stakes arena of international commerce, where economic policies can shift like tectonic plates, former president Donald Trump has once again thrust himself into the global conversation. With a directive that echoes his trademark confrontational approach, Trump has instructed the U.S. trade representative to reignite tariff countermeasures against countries implementing digital service taxes. This move promises to reignite a simmering trade dispute that could have far-reaching implications for the digital economy and international fiscal relations. In a bold move that signals escalating tensions in international trade policy,the former president is pushing for aggressive measures against countries implementing digital service taxes. The directive comes as a direct response to growing frustrations with what the governance views as discriminatory taxation practices targeting american technology companies.

Several European nations, including France, Italy, and the United Kingdom, have implemented digital taxation frameworks that impose levies on large technology corporations’ revenue generated within their borders. These measures have long been a source of contention,with U.S. tech giants arguing that such taxes unfairly single out American companies.The trade representative has been instructed to conduct a extensive review and develop retaliatory strategies,perhaps including new tariffs on imported goods from countries implementing digital service taxes. This approach mirrors previous trade confrontations where targeted tariffs were used as a diplomatic and economic leverage tool.

Preliminary assessments suggest potential tariff rates could range between 15% to 25% on select imported goods, targeting key economic sectors from affected countries.The strategic move aims to create economic pressure and potentially force negotiations or policy reversals.

Legal experts suggest the action could trigger complex international trade disputes, potentially escalating through World Trade Institution channels. The proposed measures reflect a continuation of aggressive trade policies that characterized the previous administration’s approach to international economic relations.

Technology industry leaders have expressed mixed reactions, with some supporting potential protective measures while others worry about potential retaliatory actions that could disrupt global supply chains and international business operations.

The decision underscores ongoing challenges in developing consistent international taxation frameworks for digital economic activities. As technology continues to transcend traditional geographic boundaries, governments worldwide are grappling with how to effectively tax digital revenue streams.

Economic analysts predict the proposed tariffs could have significant ripple effects across multiple industries, potentially impacting technology sector investments, international trade dynamics, and bilateral economic relationships between the United States and targeted countries.

The timing of this directive coincides with broader discussions about global digital taxation reforms, with the OECD and G20 nations actively negotiating multilateral approaches to address tax challenges arising from digital business models.

While the ultimate implementation and effectiveness of these proposed tariffs remain uncertain, the directive signals a continued aggressive stance on international trade policy and digital economic regulations.