In the digital age, where algorithms promise shortcuts and artificial intelligence whispers financial wisdom, I embarked on an unconventional quest: seeking monetary enlightenment from an AI chatbot. Armed with curiosity and a hint of skepticism, I turned to ChatGPT, the language model that has become both celebrated and controversial, to uncover the elusive “cheat code” for maximizing personal finances.What unfolded was a conversation that blurred the lines between technological advice and human intuition,revealing surprising insights into the complex world of money management. Navigating the complex world of personal finance can feel like trying to solve a Rubik’s cube blindfolded. But what if there was a shortcut to financial success? I decided to tap into the digital oracle of artificial intelligence to uncover some possibly game-changing money strategies.

The first piece of wisdom emerged around investment diversification. It’s not just about throwing money into random stocks or mutual funds, but creating a strategic portfolio that balances risk and potential returns. Think of your investments like a well-crafted playlist – you want a mix of genres that complement each other and keep the overall performance smooth.

Budgeting took center stage in the recommendations. Gone are the days of elaborate spreadsheets and restrictive tracking.Modern approaches suggest using the 50/30/20 rule: 50% of income for necessities, 30% for wants, and 20% for savings and debt repayment. It’s a flexible framework that allows breathing room while maintaining financial discipline.

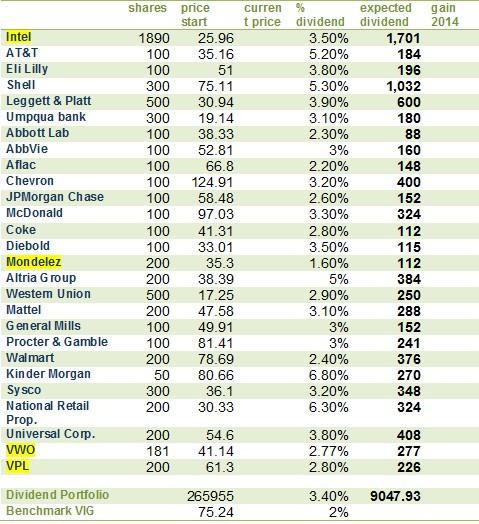

Passive income streams became another highlighted strategy. Whether it’s rental properties, dividend-paying stocks, or creating digital products, the goal is building revenue sources that don’t require constant active management.Think of it like planting financial seeds that grow without daily watering.

Technology emerged as a critical ally in money management. Digital tools and apps can automate savings, track spending, and provide real-time financial insights. These aren’t just convenience features; they’re powerful mechanisms for understanding and optimizing personal finances.

Debt management received special attention.The focus wasn’t on eliminating debt entirely, but on strategic debt reduction. High-interest debts should be prioritized, while maintaining a balanced approach that doesn’t compromise overall financial health.

Continuous learning was repeatedly emphasized.The financial landscape evolves rapidly, and staying informed isn’t optional – it’s essential. This means regularly updating knowledge, understanding emerging investment opportunities, and being adaptable.

Retirement planning wasn’t about distant future scenarios, but proactive, incremental steps. Contributing consistently to retirement accounts, understanding compound interest, and leveraging employer matching programs can create notable long-term wealth.

Side hustles and skill development presented another intriguing avenue. In an increasingly digital economy, developing marketable skills and exploring additional income sources isn’t just supplemental – it’s potentially transformative.

The overarching message wasn’t about getting rich quickly, but building sustainable financial ecosystems that provide security, versatility, and growth opportunities. It’s less about magic tricks and more about smart, strategic approaches to money management.